The New Display Ecosystem — Part I: A few words on HYPE.

July 17th, 2011

It’s been four years since I wrote one of my most popular series of blog posts of all time — “The Ad Exchange Model”. Since then a lot has happened. A whole slew of three letter acronyms has appeared: DSP, SSP, DSP, RTB… Venture capital investments have exploded, we have multiple blogs dedicated to ad-exchanges and it looks like the space has gotten a lot more complicated.

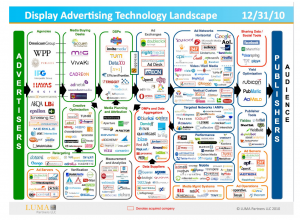

Or put another way… in 2007 I described the world with a simple diagram. Today Terry Kawaja has an industry “LUMAscape” that has logos so small I can’t even read them.

Wow. What the hell happened? We used to have this easy world… publishers sold to advertisers, there was one exchange and then a lot of ad-networks with different pitches. How the hell did we get from there to the above hodge podge “ecosystem” that nobody understands. To help bring some clarity to this world I’d like to kick off a new series… “The RTB Display Ecosystem”. This first post is will primarily be musings on hype… as before we can talk about what’s really happening we all need to step back for a second and realize 90% of what we read is… well… bullshit. I’m sure by now you’ve seen the below diagram. It’s confusing, cluttered and supposed to explain to the world how the new Display ecosystem works. 100s of companies have incorporated this slide in their presentation. I haven’t gone to a single conference where this hasn’t come up multiple times.

How VCs and Bankers brought hype to the industry

Here’s the hard truth people don’t like to hear. The display world is actually not that complicated. Yes the ecosystem has evolved. Exchanges are core tenets of display and there certainly has been a ton of innovation in the data space. But that doesn’t make for 20 boxes on a slide. What really happened is that online advertising captured the attention of silicon valley… complete with a massive influx of VCs, $, TechCrunch posts and of course… HYPE.

You see, Venture Capitalists make money off of home runs. The top companies in a category get great exits, and after that valuations drop off very quickly. To actually be able to justify an investment a VC has to be convinced that the company has a chance at being top in it’s category. Well, this is quite hard to do if the world were simply advertisers, publishers and ad-exchanges. So what do you do? Well… you create a new category, pump millions of dollars in a company marketed as such category, and then hype up this category on TechCrunch as the next greatest thing and rejoice.

Of course VC’s have coffee with each other, hype up their investments to their VC friends (ever heard of an “Echo Chamber”?), and now they’re all clamoring to invest money in other companies who could vie to be a winner in the category and a new slew of companies gets funded.

In 2006 it was impossible to differentiate yourself as an ad-network… and thus every ad-network rebranded as an exchange. In 2007/2008 nobody could raise money as an “ad exchange” that would compete head-to-head with Google and Yahoo. But “SSP” worked out quite well… even though it’s exactly the same business model (queue funding for Rubicon, Admeld & PubMatic, etc.). In 2007/2008 you also couldn’t raise money as an ad-network, but there were plenty of companies interested in helping advertisers spend their money… enter the “DSP” category (queue funding for MediaMath, Turn, Invite Media, etc.). What’s funny is that TMP was doing the SSP business before anybody else and Ad.com has been offering “DSP Services” since .. well, forever!

VCs are also obsessed with investing in “Technology Companies” that build “Scalable Platforms”. You see, Technology is supposed to be sticky. Platforms have ecosystem effects and become $1b companies. To adapt, companies have quickly adjusted their positioning to better reflect attributes that will attract high valuations from said Venture Capitalists. Again, ad-network isn’t sexy, but a technology “Demand Side Platform” is. The funny thing is… it’s hype yet again. Most companies on the LUMAscape slide receive the majority (if not all) of their revenue from media services and not technology fees. Now this line is blurring (more on that later) but what companies are doing is saying they are “technology providers” while behind the scenes they operate exactly like a media company. An “SSP” technology provider hands out tags to publishers and then pays them a check at the end of the month together with a nice excel sheet. This is exactly the same business model of many an ad-network.

Don’t get me wrong — I’m not saying that any of the aforementioned companies aren’t or can’t be great companies. Many of the companies I mention have built terrific technologies and great businesses and some have followed that up with successful exists. But, they did all capitalize on a great marketing opportunity, at the expense of some “old world” companies who were too slow to react.

And this is where VCs and Bankers are actually hurting the industry rather than helping. They are reinforcing the importance of new categories that in themselves shouldn’t necessarily exist. Rather than focusing truly on what a company does they repeat and hence validate what companies say they do.

So what’s next?

Well first, let’s stop the hype cycle and start celebrating real successful businesses for what they have accomplished. Give me more case studies of real results and less BS!

In the coming blog posts I’m going to lay out the new RTB ecosystem and how all the different parties are interacting. Your feedback is as always invaluable so please leave comments with specific topics you’d love covered.

Related Posts:

- Exchange v. Network Part II: Adoption

- Adotas Premium v. Remnant Series

- On Scale Webinar!

- On Scale Webinar Recordings

- Quality Matters!

-

http://twitter.com/nadahalli Tejaswi

-

http://twitter.com/jessas jessas

-

Anonymous

-

Pub_licite

-

http://www.ronnussey.com/2011/07/18/links-for-2011-07-18/ links for 2011-07-18 » Wha'Happened?

-

Anonymous

-

Controversial

-

Anonymous

-

Anonymous

-

Anonymous

-

Anonymous

-

Anonymous

-

http://twitter.com/ayusman ayusman

-

http://www.russfradin.com rfradin

-

Anonymous

-

http://www.russfradin.com rfradin

-

J_Curran

-

http://www.facebook.com/profile.php?id=670282984 Julian Tol

-

http://twitter.com/ganeumann Jerry Neumann

-

Louis moynihan

-

Guest

-

Guido

-

http://www.mikeonads.com Mike Nolet

-

http://twitter.com/ganeumann Jerry Neumann

-

http://www.facebook.com/kennygrant Kenny Grant

-

http://www.adotas.com/2011/07/the-new-display-ecosystem-part-i-a-few-words-on-hype/ The New Display Ecosystem, Part I: A Few Words on HYPE

-

Nene

-

Nene

-

Tyler Pines

-

http://www.exchangewire.com/blog/2011/07/29/five-stories-in-ad-tech-you-might-have-missed-this-week/ Five Stories In Ad Tech You Might Have Missed This Week | ExchangeWire.com

-

http://judewa.com/?p=461 The New Display Ecosystem — Part I: A few words on HYPE | Judewa

-

http://www.recoverybull.com files restore

-

http://twitter.com/giladhellerman Gilad Hellerman

-

steveg

-

http://www.usbdrivedatarecovery.com card recovery download

-

Xuehua Shen

-

http://www.zip-repair.org/ repair corrupt zip files

-

http://www.key-logger.ws/ keylogger

-

sachin ruhela

-

http://www.keystrokecapture.ws/ keylogger

-

http://www.facebook.com/people/Tesla-Berry/100003892763288 Tesla Berry

-

Lnunes

-

http://www.facebook.com/people/Chris-Williams/622618242 Chris Williams

-

http://www.exchangewire.com/blog/2013/10/08/exclusive-mike-nolet-cto-and-co-founder-at-appnexus-discusses-his-departure-from-the-company-and-why-he-is-leaving-ad-tech/ EXCLUSIVE: Mike Nolet, CTO & Co-Founder at AppNexus, Discusses His Departure From the Company & Why He is Leaving Ad Tech | ExchangeWire.com

-

http://www.customizedfatlossplus.com/ customized fat loss

-

http://apple.com/ Colin Campbell