Premium vs. Remnant — (Part II — Demand)

May 14th, 2007

In Part I we discussed some basic economics and then analyzed the aggregate supply curve that we see in online advertising. We also brought to the table one argument against ‘premium’ vs ‘remnant’. In this post we will look at the demand side of the equation and discuss some arguments for and against splitting out the advertiser market.

What is Demand?

Whereas the supply curve modeled all the possible sources of ad-inventory, the demand curve models all the individuals that want said inventory and have the dollars to buy it. There are many different types of buyers out there, and everyone will put them in different buckets. It’s actually quite confusing, some say ‘premium v. remnant’, some say ‘brand v. performance’ and some other will give you 18 different categories of buyers. Big brand, small brand, big performance conscious brand… etc. etc. etc. For the purposes of this post we will stick with ‘premium’ and ‘remnant’. We will consider premium the pre-reserved demand and remnant everything else.

Premium Demand

Typically coming from ad-agencies, premium demand had some very interesting characteristics. As Greg Yardley pointed out in the comments of Part I, it’s not so much ‘premium’ as a ‘forward contract’. What this means is that most will consider premium premium not because it’s special, simply because someone has reserved this inventory before-hand. The majority of reserved inventory goes to — agencies. Agencies want to ensure that they spend all of their allocated budget by the end of the month/quarter, hence they reserve large portions of inventory before hand to ensure they hit their goals.

Because of the nature of agency budgets and reservation systems, short term premium demand is simply a fixed dollar amount . Think about it — agencies get a certain budget to spend for the quarter and fight their hardest to spend every last penny. If they don’t then they’ll have less money to spend next quarter. Now of course agencies will try to get the best inventory possible for the amount of money that they have to spend, but it’s really a battle between publishers as to how big a slice of the premium money pie they can get.

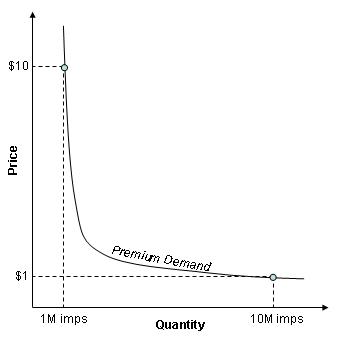

Lets take a hypethetical economy which has premium advertisers that want to spend $10,000. These advertisers will pay a rate that depends primarily on the amount of inventory that is available to them. If the marketplace only had one million impressions available, then the advertiser would buy the inventory for $10 CPM (CPM == Cost per Mille, or price per thousand impressions). That way:

On the contrary, if there were ten million impressions available for purchase then the advertiser would simply pay $1 CPM. That way:

Starting to get the picture? “But Agencies care about performance!!” you might respond…. Well, how do you track ‘performance’ for Ford? Are you going to track the number of cars that people buy online? Brand metrics are fuzzy by nature — people track “aided brand awareness”, “message association” and “brand favourability” (source)! Well — enough words! We can quite easily depict the “fixed $ demand” idea as a demand curve. If we know that $10,000 will go to premium advertisers then as shown above we can calculate the price that will be paid for each possible quantity of inventory. Price X Quality must equal the total dollar demand at each point. If we plot all the points we would get something like this:

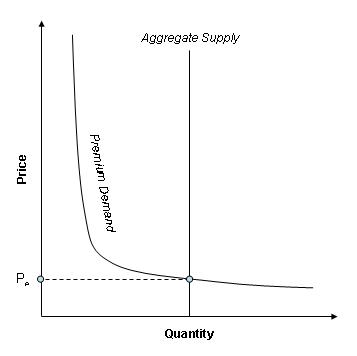

Ok, so now it’s pretty easy to show what would happen in a world where there was only ‘premium demand’, and a fixed amount of short term supply. You’d simply get:

The equilibrium price, ‘Pe’ would simply be the intersection of the ‘premium demand’ and the fixed supply curve. No matter what the quantity is, the total value of the market stays the same — it’s simply the amount of dollars allocated for that time period. The rates will simply change according to how much supply is available.

“Remnant” Demand

Of course the world really isn’t that simple. Enter remnant demand. I myself have never really like the term remnant but that’s primarily because way too many people pronounce it remAnant. So what is it? I guess people will have their own definitions but I would classify it as anything that hasn’t been reserved at a fixed price. Any CPA or CPC based deal would most likely classify as remnant, as well as any non-guaranteed CPM buys.

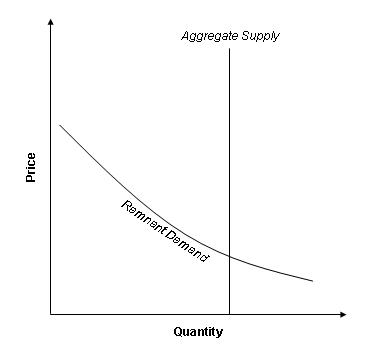

Remnant demand is a little more sensible than premium demand — performance will generally matter for these advertisers. This means that there is no longer a ‘fixed’ amount of money flowing into the marketplace, rather, the amount differs depending on the quantity and price at any given point in time. If inventory is cheap an advertiser will buy higher quantities than if the inventory is more expensive. Visually it would look something like this:

The price paid by the publisher would be the intersection of the two curves — OR — if he is successful at some basic Price Discrimination it may be the area under the remnant demand curve (my economics is getting fuzzy). The really interesting question is: what happens when you combine remnant and premium?

The Aggregate Demand Curve

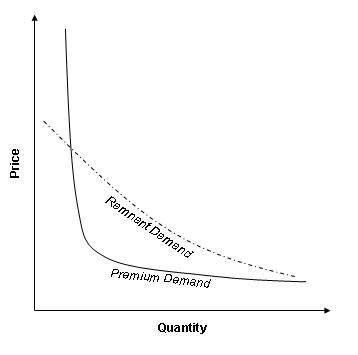

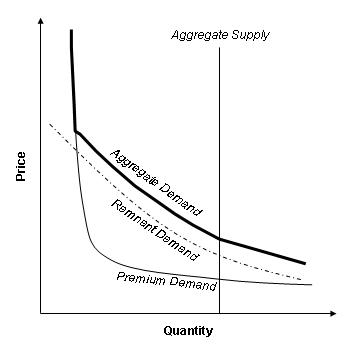

The way to combine the interaction of the premium and remnant demand curves is to think like a publisher. First, lets overlay the two graphs:

Now, lets imagine that all supply is controlled by one publisher and that as this publisher we are guaranteed the $10k in premium demand and now simply have to figure out how to price my inventory to maximize my total revenue. Well, lets think about this. Imagine that the quantity of inventory available in the marketplace sits very close to the left of the graph, a bit to the left of the intersection of the premium and remnant demand curves. At this point the supply curve intersects the two curves where the premium curve is above the remnant curve hence the publisher will allocate all of his inventory to premium demand. This makes a lot of sense right? The premium publisher will pay a higher price which would net the publisher higher revenue.

So here’s the question — what happens when supply lies to the right of this intersection? Well, what would you do if you were the publisher? What I would do is pretty simple. I’d convince premium advertisers that they have to pay more to reserve and allocate a the percentage of my inventory to the left of the intersection to them at a high price — one that’s would generally be higher than the one that remnant advertisers would pay. All other inventory I would sell to remnant advertisers. Ok, so what does this look like? Well simple! We simply vertically add the two curves as follows:

We can simply combine the premium and remnant demand curves to form the aggregate demand curve.

Lets get back to the point

Ok, so that was a whole buncha mumbo jumbo economics. What was the point? We drew some fancy curves and discussed some intersections… so what? Well, we were talking about premium and remnant, specifically why people should stop splitting out the online ad market between the two. Well, how does the above help us? Well first off, from a marketplace perspective it is not difficult to combine premium and remnant. This is my second argument against splitting out the two. When a publisher is trying to maximize revenue, he should be thinking about aggregate demand, not premium and remnant.

Think about some things that might maximize revenue:

- Improve page quality for ad performance

- Attract more and higher quality users

- Increase visitor frequency

- Improve sales efforts

- Improve monetization/optimization tactics

- Leverage behavioral data

How many of these apply solely to premium or remnant? None of them. All of the above are tools that a salesperson can use to grab a bigger piece of the premium pie. All of the above are also things that can help performance advertisers optimize their campaigns. Sure, selling to premium advertisers is different from selling to remnant advertisers, but that can easily be solved by hiring diverse salespeople and focusing them on the right areas. Nowadays most publisher get a significant portion of their revenue from remnant, hence when talking about growth rates in revenue we are really talking about growth in aggregate demand. Here’s the thing — the best techniques for maximizing revenue for publishers are not specific to performance or brand.

So all you fancy wall street analysts — when you’re asking large publishers whether their new focus on behavioral technologies will decrease revenues from premium inventory — stop and think about what you’re saying. There is no such thing as ‘premium inventory’. There is ‘premium demand’, but except for sales no company should make it one of their strategic goals to increase their share of this pool.

Final Thoughts

Before Greg can steel some of my thunder again — part III of this series will be about the growth of remnant and why I expect growth rates in “premium demand’ to slow whereas “remnant demand” will continue to grow drastically. (no it’s not related to social networking). I would also like to mention in the spirit of full disclosure that I know very little about the agency business and most of the statements I made above are based on things I’ve heard from colleagues and friends but not from personal experience.

Also — my economics are definitely fuzzy. I wish I had more time to go and read my old textbooks again, but sadly that isn’t the case. I would greatly appreciate pointers on mistakes I’ve made as I’m sure I’ve oversimplified the problem by quite a bit.

Related Posts:

- Adotas Premium v. Remnant Series

- Premium vs. Remnant — (Part III — Remnant)

- Premium vs. Remnant — (Part I — Supply)

- Welcome to Q2, goodbye ad revenue?

- Exchange v. Network Part II: Adoption

-

http://www.digitalrepublic.com.au Julian Tol

-

http://www.zip-repair.org/ repair corrupted zip file