The World is a’ Changing

November 10th, 2008

Unless you’ve been living under a rock somewhere you’ve probably heard that the whole world is crumbling around us. We’re entering the great depression, guard your cash, no more VC, we’re all POOR.

Well, first let me reassure you — so far the nuclear winter hasn’t started yet. The data that exists so far has been fairly sparse and inconclusive — Google is up, AOL is down… Rubicon claims the sky isn’t falling whereas PubMatic claims prices are steadily falling. I’ve had quite a few in depth discussions over the past few weeks on exactly this topic — where is the industry headed? How is the economic downturn affecting online advertising? What are the big boys doing? What’s new exciting?

Last week’s AdECN announcement and a short stroll through the booths at AdTech finally motivated me to get up and write another blog post! (sorry for my absence, life is pretty hectic these days). So here goes in no particular order my views of exciting things in the market today and what’s coming next.

The traditional “marketplace” network model is dead

By traditional networks I mean the models that ValueClick, Casale and Ad.com were founded on — networks that were primarily built by matching large amounts of supply and demand. The name of the game was to get as many advertisers and publishers together as possible to build the largest marketplace. Once the network was large enough, ad dollars naturally flowed to these players as they were a “one stop shop” for thousands of publishers. Large margins are made by buying low and selling inventory to advertisers at a higher price.

This model was used by many companies to build incredibly successful networks — and in fact — most of these networks are *still* very successful. The problem is, the world is changing. Namely:

First, access to inventory is no longer a competitive advantage. Between Exchanges, publisher aggregators and a mass influx of social networking inventory — everybody has access to billions of impressions.

Second, agencies want to cut out the middle man. Agencies have started to realize that networks are taking massive cuts out of their media buys while in many cases simply serving as an aggregator. And indeed, with supply easier and easier to get access to, many agencies are launching initiatives to cut out the middle man. Whether it’s the new Havas Artemis system, the Publicis Vivaki network or the WPP 24/7 acquisition — they’re all moving in the same direction.

Essentially — networks are getting pressure from both sides. On the supply side they are getting commoditized by aggregators and network optimizers and on the demand side a new crop of technology companies is attempting to empower agencies to buy directly — cutting off the ‘marketplace’ networks.

The rise of the pubgregatimizer

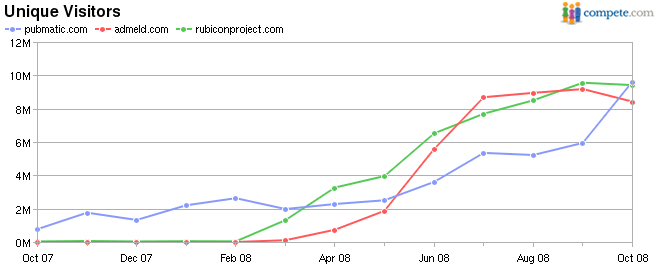

Publishers have finally realized that they might not be the best ones to sell their non-guaranteed inventory. Three well funded companies have emerged that are looking to help publishers navigate the sea of ad-networks and best monetize — PubMatic, Rubicon and AdMeld. I think the value prop is obvious — only the largest of publishers can afford the staff to fully manage the distribution of remnant inventory across various networks. At the moment it looks like the three are neck & neck in terms of unique visitors:

Decreased growth rate will force more accountability for agencies

Although the sky isn’t falling, money is getting scarcer. This scarcity will force everyone along the entire value-chain to be more competitive. This will start with the agencies and go all the way to the publisher — everyone will have to prove both effectiveness and figure out new ways to differentiate themselves from others. Scarcity of dollars will also put pressure on agency margins forcing them to look elsewhere on ways to increase their revenues.

Some initiatives have already started here — Publicis has launched Vivaki, WPP bought 24/7 and Havas has Artemis. Although the exact strategies are vague, one thing is clear — Agencies are going to start getting more involved in the buying process as they see their margins drop to 10% or below whereas our traditional networks (dying per the above) are still pulling in 30-50% margins on their media.

The challenge here is that most agencies aren’t setup to buy effectively online. Buying online is much more about technology, analytics & strategy than it is about creativity, ingenuity and imagination. To buy effectively online an agency needs to start working on it’s brain — which of course is currently largely dominated by “right brain” creative folks and lacking in “left brain” analytics. One of the things we see here as an increase in popularity of the ‘media trading experts’ — networks that focus exclusively on helping agencies buy the best possible media for their clients. Leveraging exchanges & aggregators instead of traditional ties to publishers these networks can serve as an unbiased agent of the agency.

Exchanges will move to real-time integration

Even though only one has made it public — AOL, Yahoo, Microsoft & Google are all working on real-time integrations. Why? Any central trading platform for media needs to support different engines & algorithms. If nobody can differentiate themselves on a platform, then nobody will want to use said platform! Although Right Media was a terrific step forward as the first central trading platform, it’s major flaw is that it took the technology out of the network. Real time bidding platforms solve that by allowing smart advertisers & networks to run their own engines. With the big 4 all working on something… it’s going to be interesting to watch what happens!

This combined with all of the above show a great picture for technology focused ad networks. As I wrote about earlier here and here — it is the difficulty of integration that has limited many an online ad technology startup from succeeding. With supply becoming more and more available in more and more programmatic manners — a time is coming when the guy with the best algorithm will actually stand a chance competing against the guy with the best relationships at WPP.

Final Thoughts

This is an incredibly exciting time in the industry — the whole industry is fragmented, there is little standardization and there is a massive amount of pain. I think big changes are coming. I’ll try my best to be a little more prompt about blogging about it while it happens

Also — if anybody is going to be at Adrevenue 08 and wants to meet up, shoot me a note.

Selling behavioral data in a multi-platform ad-industry

July 26th, 2007

Not too long ago I wrote a post One buyer, many cookies, now what?. In that post I promised that I would write about how buyers can best operate in the coming market with multiple platforms — and hence multiple cookies & adservers.

A quick refresher

In prior posts I have stressed the following:

- An exchange or ad platform, fundamentally an adserver

- Adserving is still tied to one cookie.

- Behavioral targeting is tied to knowledge about a user

- Knowledge about a user is stored in the cookie (whether as a unique user id or the actual data)

If that didn’t make sense — go read some of my older posts first.

Behavior is the future!

A single exchange with a single cookie space would have enabled true global internet wide behavioral targeting. Lets imagine I wanted to remarket to mikeonads.com users. All I would have had to do in a single platform market is add my visitors to one behavioral segment on one exchange and then place buys on that segment. Sadly this is not likely to happen since the three major internet giants swooped in and acquired practically every adserving/exchange/marketplace up for grabs. So what would I do in a world with three platforms? Lets talk about some options.

Option #1: A global user-id

Imagine this — an independent entity that offers a global user-id database. Every marketplace, ad-network or exchange subscribes to this UID service and syncs their user-ids with the global user-id. So even though Google might think that you are user #12345 and Yahoo might think you are user 54321, I can use global UID database to map your mikeonads UserID of #164 to Yahoo’s 54321 and Google’s 12345. I then simply signal to Yahoo that user 54321 is a mikeonads.com user and similarly to Google. Now each exchange knows who my users are and theoretically I can then target campaigns to my users.

Chances of this happening? Pretty close to nill. First off you’d need an independent company to provide the global UID space because none of the giants would want to give up control to another on this front. Then this conglomerate would have to get past scrutiny from the FTC, FCC, FBI, CIA and who knows who else before being able to launch, and then finally somehow convince end users, who would have probably gotten wind of this from all the press coverage, that this wouldn’t be an invasion of privacy.

Option #2: Massive user-segment mapping

In theory this solution isn’t too different from the above except that it requires browser-side communication of segments. Instead of having a global user database which allows companies to merge and map their data you simply signal each individual piece of information to each platform. If I were Revenue Science, Exelate or Tacoda I could sign up with Google, Yahoo & any other source of supply and set up my user category mapping in each system. Then, when I decide whether to add a user to a segment I fire off pixels (or whatever method to add a user to a segment) for each system.

Lets go back to remarketing to mikeonads.com users. Some people might find this a little confusing, so I made a little diagram:

Lets walk through the steps (btw, this is hypothetical, I’m not actually tracking you like this!)

- You come to mikeonads.com

- The html for the site contains three img tags that point to various platforms

- Your browser loads the Google pixel

- Google updates it’s user database and adds info to your cookie

- Your browser loads the Yahoo pixel

- Yahoo updates it’s user database and adds info to your cookie

- etc.

Why does this have to work this way? Cookies! Each company has a different UID and each UID is stored in a cookie. For Yahoo or Google to store data on this user they must know who the user is, for which they need access to the cookie, which means the user’s browser has to request content from their servers.

The above is actually a perfectly feasible model and practiced a fair amount today. The problem is that it’s difficult to scale — sure if all I want to do is tell each platform that you visit my site it’s pretty easy. But what if I have thousands of different user segments and then have weights and scores on each?

Option #3:Tagging users based on value

Instead of building a mapping of a thousand different categories across five different platforms there is another solution — flagging users based on value. Lets say I rank my behavioral segments into ten different buckets, from very low to very high value — for example, users interested in credit-cards are far more valuable than users interested in harry potter. After having assigned a value priority I can then create ten different segments in each supply platform that I want to work with. Each time I have access to a user’s browser I fire off one of the ten segments to each of the supply platforms to signal the value I place on this user, much like option #2 above. Note that I still place the exact category in my own user database.

Once I have flagged users based on value I can then place a media-buy with each platform at different price points based on the ten user segments. For example, I can have one $5.00 CPM campaign for all the high value users, credit-card and auto buyers, and a $0.50 campaign for the less interesting behaviors — low-income family, under 18, etc.. Each time I win a campaign I have the platform redirect the user to my adserver where I pick my own ad to serve based on the exact categories that the user in. The major draw-back of this approach is that it forces third party adservers. To some extent this is inevitable but this is non-ideal from a creative review, discrepancy and user experience perspectives.

Final Thoughts

Even though the industry won’t be standardizing behind one platform there are several methods of enabling cross-marketplace behaviors. Obviously there are some privacy concerns that will have to be ironed out, but those are independent of the platform being used. Also, if you own a site and are interested in remarketing to your users in ways I describe above you should check out Advertising.com’s LeadBack service which allows you to do just that!

Yahoo v Google — Are times-a-changing?

July 18th, 2007

This morning a friend of mine pointed me to a paper titled Are Cover Stories Effective Contrarian Indicators?. The article is probably best summarized in the abstract:

Headlines from featured stories in Business Week, Fortune, and Forbes were collected for a 20-year period to determine whether positive stories are associated with superior future performance and negative stories are associated with inferior future performance for the featured company. “Superior” and “inferior” were determined in comparison with an index or another company in the same industry and of the same size. Statistical testing implied that positive stories generally indicate the end of superior performance and negative news generally indicates the end of poor performance.

Interesting right? Good cover stories on BusinessWeek and Forbes imply you won’t be doing well, whereas bad cover stories indicate change is coming! Ok, so lets look at Yahoo & Google.

In May of 2001, BusinessWeek published a story title Inside Yahoo! The untold story of how arrogance, infighting, and management missteps derailed one of the hottest companies on the Web. Clearly, not very positive. What happened to the stock? Stock hit rock bottom a few months after the article and within 2 years was double the price from the date of publication. You can see the carts here.

Ok, so of course that’s purely anecdotal and doesn’t mean much. But considering all the recent turmoil, I wouldn’t be surprised if we saw Yahoo on a cover soon as the “biggest screwup of all time”. You know what? How low can they go? Yahoo has some great assets and great talent. Sure, they’ve had some shitty leadership recently but it’s pretty clear that’s been changed.

In no way would I start buying stock based on this post (hey, there hasn’t been a negative cover story yet!), but I don’t expect Google to stay at the top for very long. When you’re the best it’s difficult to strive for more. And you know what? In April of this year, Google was featured rather positively in a cover story on businessweek titled Is Google Too Powerful? .

One buyer, many cookies, now what?

July 12th, 2007

Introduction

Back in March I wrote a post titled “Battle over the Cookie. I’m going to quote myself real quick — (I know, kind of tacky)

So why the title “Battle over the Cookie”? Well, people are starting to catch on that if they own the cookie, they own the market. Think about it, if one exchange succeeds in capturing a massive percentage of the market, the barriers to entry will be practically insurmountable. What value is your exchange if you can’t provide services like global frequency caps, cross publisher behavioral targeting, etc. etc.

So who’s fighting? Well, my employer (Right Media) for one. Doubleclick is said to be launching a marketplace, AdECN is another. I’d expect others to start soon — as long as someone hasn’t won, there’s still a chance.

Well, as we all know, Right Media has been bought by Yahoo (if you hadn’t heard yet, the deal closed today), Google is buying DoubleClick, etc. etc. etc. So how are these developments changing the battle over the cookie?

There won’t be a single cookie

That’s right. It ain’t happening. At the minimum there are going to be three different marketplaces, three different adservers and hence three different cookie domains. Think about it — Google/Yahoo/Microsoft are arch-rivals and even though some may build more open solutions than others they are most definitely not going to be fully integrated, and they most definitely won’t be sharing a single cookie space. Add on to that the remaining independent adservers (e.g. AdECN, Zedo, OpenAds) and I don’t see any way in which there will be one unified marketplace.

To be honest, this saddens me quite a bit. One single marketplace would have been extremely beneficial to both publishers and advertisers, but of course there are simply too many people fighting to control the means by which ads are transacted. Ok, so now what?

What’s next?

To be honest — it’s too soon to really tell how this new battle is going to unfold. I don’t think it’s very clear what Microsoft, Yahoo or Google (how about we call them MYG) are going to be doing with their new acquisitions. One thing is clear, it’s going to be difficult to get access to inventory without working with MYG. Advertisers should benefit from consolidated buying. I imagine that networks not working with MYG will find it difficult to survive without a really compelling story and publishers should benefit from increases in both innovation and competition.

In the next couple posts I will be digging into how companies should prepare for this new online advertising landscape — How will ad-networks continue to grow over the next couple years? How can large publishers increase rates by leveraging the new marketplaces? How will behavior work without a single cookie? CAN behavior work cross-platform?

Should publishers fight for control?

July 3rd, 2007

Users, not advertisers

A friend directed me to an interesting post on Publishing 2.0 — ‘Ad Platforms vs. Ad Networks: Who Controls The Advertiser Relationship?‘ — using the new Time Inc/Quigo relationship as an example the author argues that “As more advertising dollars pour online [...] whoever controls the advertiser relationship holds all the cards”.

This comment made me think for a while about the publishers role in online advertising. Is it really all about building advertiser relationships? Most publishers that I have talked to over the past few years split their media into two buckets — premium & remnant. One sales force focuses on agencies and another on ad-networks and direct marketers. Often the second salesforce is one or two people who spend their days prioritizing networks.

Although advertiser relationships matter a lot on an individual deal basis, but I don’t see them as something that can be “controlled”. Think about it — lets say you have a great “premium” sales guy, Joe, who has solid relationships with two large agencies. He used to work at one and has a whole set of friends at the other. Quarter after quarter Joe just keeps bringing in tons of business. Well, what happens when Joe is poached by another company and leaves? Was the strength of the relationship based on Joe or on the company? What if Joe calls up the agencies from his new job and tries to convince them to move their dollars to his new gig? Who will the agency go with? It’s not that relationships aren’t valuable, but they are largely based on personal relationships between people — something that is far more fragile than a deep technical integration.

If it’s not advertiser relationships, what should publishers focus on? First and foremost every publisher should focus on increasing the user-experience on his properties, attracing more and higher quality users and collecting more information about said users. I think Niki Scevak has it right in this post — Running an Ad Network — where Niki argues “You’ve heard me crap on about the business model of ad networks enough but here it is again: over time all the value goes to the person who owns the consumer relationship.“. It’ kind of like that movie Field of Dreams, “If you build it, he will come”. Not that you don’t still have to work to bring in the advertiser dollars, but quality users make selling a lot easier.

The means of trading

So lets look at the example Time/Quigo cited above. Pre-Quigo, Time used Adsense because it enabled both contextual based buying and smaller credit-card based advertising on Time Inc. Adsense was able to provide a certain level of efficient buying and hence was able to pay higher rates than other advertisers. Citing from the Media Post article on the subject, Quigo states that “This is about publishers who want control over the ad-serving process, rather than outsourcing it to a blind network.” Well, I call bullshit!

This isn’t about Time gaining control — they’re simply transferring control from one party to another. Before the deal they had control over their users and inventory, and now they still have control over their users and inventory. The only real difference is that instead of sharing some margin with Google & Yahoo they are sharing some margin with Quigo. Quigo is getting exclusive control over the contextual advertising on Time Inc. Not convinced? Why don’t we take a look at the terms of service of a contextual buy on Time Inc

1. Display of Advertisement. Advertiser agrees that Quigo may display the advertisement Advertiser places in the AdSonar interface (the “Advertisement”) on the Quigo Network through the AdSonar Service and its affiliated sites on which Quigo places AdSonar advertisements

That’s right — this isn’t an exclusive Time Inc contextual advertising account I just signed up for, it’s a full-fledged Quigo account, it even works when I go login through the regular Adsonar login portal. So Time transferred control over the means of serving the ad from Google & Yahoo over to Quigo. So why do we care? The thing that is up for control is the means by which ad-impressions are traded or transacted. In the example above, Quigo may have tricked Time into thinking they were getting more control but really it’s three giants battling over one method (contextual matching) of serving ads on Time Inc’s inventory.

I find it hard to believe that this is financially the best move for Time. If Google or Yahoo pays a higher rate than Quigo, do you really care whether you are “selling directly” or not? Which brings me to my last thought of the day. Assuming a publisher has built up a quality user base, the focus should be on empowering all advertisers to best monetize the available inventory. Who cares if it’s Yahoo, Google, Quigo or even Bidclix! Whomever pays the most should get the inventory. If today that’s Google, great, but if tomorrow it’s Quigo then give more to them.

Next up

I realize that this post leaves a lot of questions unanswered — in my next posts I’ll talk more about maximizing revenue by pricing networks efficiently and also about how ad-networks, exchanges and technology providers are fighting for control over the means by which ad-inventory is traded.

Google Recommending Yahoo Pipes

May 7th, 2007

The developers over at the Google Maps API posted an interesting post today about how to integrate Yahoo! Pipes with Google Maps. Didn’t think I’d see the day where Google would be recommending a Yahoo service, but pretty cool that they’re allowed to! I really love this new age of APIs for everything. Will we soon see a whole industry of services that simply provide integration between various offerings using APIs?

The Ad Exchange Model (Part III)

May 4th, 2007

I’d like to continue my series. If you haven’t already, be sure to read Part I and Part II first.

After my first two points I received multiple questions around the lines of “Who will make money off of this?”, and “Who benefits most?”, “How will ad-networks survive in this environment?”. Well, I thought we’d take a look at the various types of players in the market today and discuss how they will thrive/survive/die in the exchange environment. When discussing each of these I imagine a world in which there are two or three major ad-exchanges. Say, Googleclick, Righthoo & Micro7 … Any business that wants to play has to in involved with one or more of the exchanges as in this new world, 95% of all inventory gets sold on the exchange.

The REAL Right Media Contract

May 3rd, 2007

Yes… that’s right, that’s crayon on a table-cloth. Read this article for details: Yahoo! Buyout A Trip For Workers

The Ad-Exchange Model (Part II)

May 2nd, 2007

If you haven’t already, be sure to read The Ad-Exchange Model (Part I) first as this is a continuation of that post.

Technology Integration

I’m sure you’ve got a picture in your head by now that there’s an annoying manual process here. Well, the technology piece gets worse. Today, most technologies that companies will consider “competitive advantages” are either optimization/prediction algorithms, contextual engines or behavioral datasets. Say we have this company called Google that has a great technology that matches ads to page content. The payout on each click depends greatly on what the ad is for. Pages relevant to autos or medication will net far higher payments than pages about the local pizza joint. So how is the publisher to decide when to show ‘Adsense’ over the $1.00 CPM deal he just signed? There’s absolutely no way for the Publisher to know the effective CPM of the adsense ad before he shows it.

Currently there are two ways that publishers manage this problem. The first is to simply accept an inefficiency in pricing. He may prioritize Google Adsense at $0.95 CPM across all pages because on average that’s what he can expect to receive at the end of the month. The other option would be to setup tens or hundreds of different tags targeted to different types of pages and then setup different prices for each. Again, this would require setting up tens or hundreds of categories in Adsense and then trafficking tens or hundreds of different tags into the Publisher’s adserver. Not really the best solution.

What about a behavioral advertiser that wants to buy New York Times traffic because he thinks he has data on some of the users. Since the behavioral data is stored in his cookie (see my post here about behavioral advertisers) there is no way for the Publisher to know which of his users will be valuable to the advertiser! How is he supposed to price this? This one isn’t so easy. One way is for the advertiser to simply buy a flat rate for all New York Times users and then simply count the users for which he doesn’t have data as a loss. The other would be some sort of rudimentary integration where the advertiser drops a pixel for the Publisher’s cookie domain for his users. Again, not ideal, not simple and INEFFICIENT!

High Latency/Slow Adserving

Each call to a different adserver costs time. The more hops that a user’s browser has to go to to receive the actual ad, the more likely that he is to click-off to another page before he actually sees it. Try it, go to myspace.com and click through on a few links. How often did the actual ad finish loading? The higher the number of systems involved in an ad call, the higher the difference between how many impression the Advertiser and Publisher’s systems count. Last I heard, 5-10% of impressions are lost for each additional adserver that is added to an ad-chain.

The Exchange Model

Fundamentally I believe people don’t quite understand why Ad-Exchanges are key is because they don’t realize that an ad-exchange is simply a glorified adserver. Really… nothing special, just one centralized system instead of three or more. Take a look a the following diagram:

Notice a difference? In this case, there’s only ONE request to ONE system, the ad-exchange. The exchange is the ecosystem through which advertisers, publishers and networks all manage their businesses. Some may integrate their contextual technologies, some may simply use the system to set prices. But it’s ONE ADSERVER! Lets revisit the three main challenges we listed before.

Pricing/Operational Inefficiency — On the Exchange

Now that the advertiser and the publisher are both on the same system the whole world changes. There is no longer a need to transfer “tags” back and forth, as all the data is in the same system. Pricing is also no longer an issue as the advertiser has integrated his technology solution with the exchange and can now bid a different price on each ad impression depending on the page the user is visiting.

Technology Integration

Although there is still a significant amount of work to be done to integrate an Advertiser’s technology solution with the exchange, it’s worth it since it’s work that only needs to be done once. Once done, this technology will work across any and all publishers. Imagine this, the New York Times starts using Googleclick as their adserver, which is, of course, fully integrated with adsense. The NYT no longer has to worry about inefficient pricing for Adsense as the technology will be integrated with exchange. On every ad-call, Adsense can check the page content and place and appropriate bid according to the types of ads that it would place. Genius right?

Now what about the Behavioral network? Of course it will integrate it’s data with the exchange, and again, on every ad call it can enter bids on the users that it has data on and even price differently based on the types of data. Of course it will be slightly more difficult to integrate technology with the exchange adserver as by nature it’s more complex than a basic adserver, but this doesn’t really matter. Since the Advertiser only has to integrate his technology once, with one adserver it’s worth the effort.

High Latency/Slow Adserving

This one should be pretty obvious. Since there is only one request, ads serve faster and fewer impressions are lost.

Final Thoughts

I realize this post is long, but I think it’s important that people realize the true value that Exchanges bring to the market. It’ll be fascinating to see how the market changes as Google and Yahoo each attempt to take control of the billions of dollars of advertising that flow through the internet every day. This new model will truly change the online advertising world for the better, except perhaps for those ad-networks out that there purely benefit from the pricing and operational inefficiencies that exist in todays world.

Stay tuned for more thoughts on the potential acquisition of 24/7 by Microsoft, securing an exchange, ‘broker networks’!

The Ad-Exchange Model (Part I)

May 1st, 2007

Clearly the recent acquisitions of both Doubleclick and Right Media by Google and Yahoo respectively signal a strong vote of confidence in the ad-exchange model. Reading all the news coverage of these two acquisitions made me realize that very few people out there realize the true value proposition of a centralized exchange. Sure, “transparent marketplaces”, and “auction models” are great, but why is this better than any of the existing ad-networks — Google Adsense, Advertising.com, YPN, etc.?

The Basics — A simple publisher serving ads

First lets start with a really basic question — What is an adserver? Before we can talk about an exchange, you have to understand how adserving works today. In it’s most basic form an adserver serves ads on web pages, tracks clicks on those ads and then provides reporting on the ads served and the number of clicks received on those ads. In the online space today, the vast majority of publishers, networks and advertisers all have their own adservers.

Ok, so how does it really work? Well, the first thing you need to understand is how the ad-request actually happens. To request an ad from an adserver the publisher, or website, must place an ad-tag on their page. An ad-tag is simply a snippet of HTML, generally either some Javascript or an IFRAME that tells the browser to request some content from the adserver. Here’s an example tag:

<IFRAME FRAMEBORDER=0 MARGINWIDTH=0 MARGINHEIGHT=0 SCROLLING=NO WIDTH=468 HEIGHT=60 SRC=\"http://ad.yieldmanager.com/imp?Z=468x60&s=2948&t=3\"></IFRAME>

This little snipper of HTML, when placed on a web page, informs the browser to open a small window (460×60 pixels), and in that window place whatever content is returned from “http://ad.yieldmanager.com/imp?Z=468×60&s=2948&”. When I loaded this in a browser I got the following response (truncated for clarity):

<a target="_blank" href="http://ad.yieldmanager.com/click,AAAAAIQL[...]AOUINkYAAAAA,,,"><img border="0" alt=""height="60" width="468" src="http://content.yieldmanager.edgesuite.net/atoms/8c/21/8c21402b07a3ca60e6af42e48b09a3cc.gif"></a>

Which essentially tells the browser to load an image from content.yieldmanager.com (the ad), and then when the user clicks to send him to ad.yieldmanager.com/click. Here’s a basic little diagram that outlines this simple process:

Ok, so you understand the most basic implementation of a web-page with an adserver. Now lets look at reality.

Life gets complicated — the advertiser has his own adserver

In the example above, when an ad was requested the adserver immediately responded with an image. This implies that when it comes time to pay for the ads served that the advertiser is going to rely on the Publisher’s reporting system to determine how much money he owes. In reality the advertiser is interested in tracking information as well. What this means is that both the advertiser AND the publisher need to have their own adservers. Now, the publisher’s adserver can’t immediately return an ad, instead it returns a SECOND ad tag that points to the advertiser’s adserver. Here’s another pretty diagram:

Now imagine that there’s an ad-network representing the advertiser that’s sitting in the middle, in which case what we get is:

What’s wrong with this picture?

So by looking at the diagrams above I hope you get a sense that this isn’t the most efficient of ways to buy and sell media. Think about it, for each individual ad we have to request content from three different systems! This means three times too much work is being done. So lets dig a little deeper. Essentially, the traditional adserving model has three key problems:

Lets dig into these three.

Pricing/Operational Inefficiency

One of the things I forgot to mention above is that each point of integration between two adservers is manual work. If the Advertiser wants to buy 10 million impressions at $1.00 CPM from a Publisher the following process generally happens:

- Publisher sales rep contacts advertiser

- Publisher and advertiser negotiate contract terms (e.g. 10M @ $1.00)

- Publisher and advertiser sign a contract

- Advertiser sets up the ads in his adserver and sends over the “ad-tags” for the media buy

- Publisher has trouble trafficking ad-tags into his system and contacts his support department

- 5 days later, Publisher finally manages to get the ad-tags live and the campaign starts

So what’s wrong here? First off, there’s a certain inefficiency here. When the advertiser decides he wants 10 million impressions he probably specifies a certain set of targeting parameters to ensure that the Publisher sends him users that will be likely to be interested in his offer. For example, he may want over 18 males with a maximum of 4 ads shown to each user every day. Clearly there is a problem here. Depending on the offer, 18-25 males might be far more valuable than 50-85 year old males. Also, the first ad the user sees is far more likely to elicit a response than the second or third. So what do people do? Well, instead of setting one fixed price for all over 18 users he could setup 20 difference prices. Ten different age buckets (e.g. 18-25, 25-30, 30-35, 35-40) and two different frequency buckets (e.g. first ad, second through third ads). Well, this makes life a little bit better but there are still some problems here. First off, the higher the number of pricing points, the longer the entire process outlined above takes. 20 price points means 20 different tags in the Advertiser’s adserver, and 20 tags to upload into the Publisher’s adserver, and 20 different tags for which the Publisher may need to contact his support department for help. Here’s a nice little diagram –

In this new digital age of APIs and digital systems, why the hell does this take so much work? Can’t we do this in a better way? Well, at some point people realized that pricing flat CPM rates for inventory wasn’t the most efficient way to do things and came up with Cost Per Click (CPC) and Cost Per Acquisition (CPA) pricing models. In these systems the advertiser simply specifies how much he’s willing to pay per Click or Acquisition (generally a purchase, or lead form) and lets the publisher’s system determine the best users to deliver ads. Although this system is better than the above it introduces another set of problems. The advertiser now becomes wholly dependent on the Publisher’s optimization/prediction algorithms, which may or may not be any good! I can continue here for ages, but I’m pretty sure you are getting a sense of how inefficient the current system is.

Enough for one post. Stay tuned tomorrow for Part II — Tech issues and how the exchange model helps.

Update: Part II is ready, read on here: The Ad-Exchange Model (Part II)