The New Display Ecosystem — Part I: A few words on HYPE.

July 17th, 2011

It’s been four years since I wrote one of my most popular series of blog posts of all time — “The Ad Exchange Model”. Since then a lot has happened. A whole slew of three letter acronyms has appeared: DSP, SSP, DSP, RTB… Venture capital investments have exploded, we have multiple blogs dedicated to ad-exchanges and it looks like the space has gotten a lot more complicated.

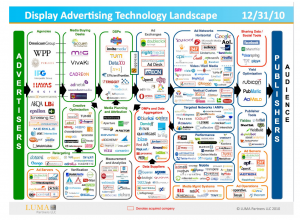

Or put another way… in 2007 I described the world with a simple diagram. Today Terry Kawaja has an industry “LUMAscape” that has logos so small I can’t even read them.

Wow. What the hell happened? We used to have this easy world… publishers sold to advertisers, there was one exchange and then a lot of ad-networks with different pitches. How the hell did we get from there to the above hodge podge “ecosystem” that nobody understands. To help bring some clarity to this world I’d like to kick off a new series… “The RTB Display Ecosystem”. This first post is will primarily be musings on hype… as before we can talk about what’s really happening we all need to step back for a second and realize 90% of what we read is… well… bullshit. I’m sure by now you’ve seen the below diagram. It’s confusing, cluttered and supposed to explain to the world how the new Display ecosystem works. 100s of companies have incorporated this slide in their presentation. I haven’t gone to a single conference where this hasn’t come up multiple times.

How VCs and Bankers brought hype to the industry

Here’s the hard truth people don’t like to hear. The display world is actually not that complicated. Yes the ecosystem has evolved. Exchanges are core tenets of display and there certainly has been a ton of innovation in the data space. But that doesn’t make for 20 boxes on a slide. What really happened is that online advertising captured the attention of silicon valley… complete with a massive influx of VCs, $, TechCrunch posts and of course… HYPE.

You see, Venture Capitalists make money off of home runs. The top companies in a category get great exits, and after that valuations drop off very quickly. To actually be able to justify an investment a VC has to be convinced that the company has a chance at being top in it’s category. Well, this is quite hard to do if the world were simply advertisers, publishers and ad-exchanges. So what do you do? Well… you create a new category, pump millions of dollars in a company marketed as such category, and then hype up this category on TechCrunch as the next greatest thing and rejoice.

Of course VC’s have coffee with each other, hype up their investments to their VC friends (ever heard of an “Echo Chamber”?), and now they’re all clamoring to invest money in other companies who could vie to be a winner in the category and a new slew of companies gets funded.

In 2006 it was impossible to differentiate yourself as an ad-network… and thus every ad-network rebranded as an exchange. In 2007/2008 nobody could raise money as an “ad exchange” that would compete head-to-head with Google and Yahoo. But “SSP” worked out quite well… even though it’s exactly the same business model (queue funding for Rubicon, Admeld & PubMatic, etc.). In 2007/2008 you also couldn’t raise money as an ad-network, but there were plenty of companies interested in helping advertisers spend their money… enter the “DSP” category (queue funding for MediaMath, Turn, Invite Media, etc.). What’s funny is that TMP was doing the SSP business before anybody else and Ad.com has been offering “DSP Services” since .. well, forever!

VCs are also obsessed with investing in “Technology Companies” that build “Scalable Platforms”. You see, Technology is supposed to be sticky. Platforms have ecosystem effects and become $1b companies. To adapt, companies have quickly adjusted their positioning to better reflect attributes that will attract high valuations from said Venture Capitalists. Again, ad-network isn’t sexy, but a technology “Demand Side Platform” is. The funny thing is… it’s hype yet again. Most companies on the LUMAscape slide receive the majority (if not all) of their revenue from media services and not technology fees. Now this line is blurring (more on that later) but what companies are doing is saying they are “technology providers” while behind the scenes they operate exactly like a media company. An “SSP” technology provider hands out tags to publishers and then pays them a check at the end of the month together with a nice excel sheet. This is exactly the same business model of many an ad-network.

Don’t get me wrong — I’m not saying that any of the aforementioned companies aren’t or can’t be great companies. Many of the companies I mention have built terrific technologies and great businesses and some have followed that up with successful exists. But, they did all capitalize on a great marketing opportunity, at the expense of some “old world” companies who were too slow to react.

And this is where VCs and Bankers are actually hurting the industry rather than helping. They are reinforcing the importance of new categories that in themselves shouldn’t necessarily exist. Rather than focusing truly on what a company does they repeat and hence validate what companies say they do.

So what’s next?

Well first, let’s stop the hype cycle and start celebrating real successful businesses for what they have accomplished. Give me more case studies of real results and less BS!

In the coming blog posts I’m going to lay out the new RTB ecosystem and how all the different parties are interacting. Your feedback is as always invaluable so please leave comments with specific topics you’d love covered.

Top 5 Media Startup Mistakes

October 7th, 2010

My first title for this post was “top 5 ad-network mistakes”… then I realized that ad-network was a “bad” term… so intead I’m going to refer to a “media startup”. I’ll put networks, DSPs, trade-desks, dynamic creative providers… any company that buys & sells media (*cough* … looks like a network.. *cough*) under this new “media startup” bucket.

It seems every young media startup I talk to keeps making the same mistakes over and over. Well, here goes in no particular order (even though they are numbered #1-#5) my list of things every startup needs to watch out for… maybe I can help prevent someone from making the same mistake!

#1 – Credit / Payment Terms

A $1M insertion order is amazing.

A $1M insertion order where you get paid net-90 but you pay out net-30 can kill your business.

A $1M insertion order where you get paid net-60 but you pay out net-60… can also kill your business.

Here’s the problem. Agency margins have been on a nose dive downwards for years now. One of the ways agencies drive up their profitability by paying everybody late and making a little extra $ on the interest they earn by keeping the money in their bank account. Even if you think the payment terms line up, just one client that sits on their check for too long can be tdetrimental to your business. If you don’t pay your big sellers they cut you off, killing your network. If you push to hard on the agency, they cut you out of next quarter’s budget.

Proper float & credit management is a must for any network. Have an open conversation with agencies and understand when you can realistically expect to be paid, and then make sure there’s always enough cash in the bank to pay sellers and publishers (and employees!). Many a media startup has gone out of business by badly managing their float.

#2 – Boobs

Did you know that perezhilton.com, wwtdd.com and idontlikeyouinthatway.com are present in some shape or form on every single exchange and supply platform from the aggregators (PubMatic, Rubicon, Admeld, OpenX, etc.) to the big guys (Right Media, Google)? These “Entertainment” sites make liberal usage of pictures of scantily clad celebrities, their sexcapades and lots of other inappropriate content.

Now on a normal remarketing campaign the performance might be great, but there’s nothing worse than an angry email from your advertiser because your ads just showed up next to this page.

In the best case your reputation just took a little hit. In the worst case your advertisers simply refuse to pay out multi-hundred thousand dollar budget amounts…. ouch.

It’s imperative that a network or buying desk has a strategy in place for managing inappropriate and sensitive content. Don’t assume that the “Entertainment” channel is fun sites that you can run any advertiser on… you’ll be in serious trouble if you do. On RTB you obviously get the URL, so use it. Supply platforms also have various forms of brand protection… Advertising online is kind of like teenage sex… first take a sex-ed class to learn what the forms of protection are … and then don’t forget to use protection in practice!

#3 – Malvertisements

Here’s a very common story. One of your sales guys comes in super excited… he just closed an *amazing* deal. $0.75 CPM, no goals, all european countries for a major brand-name advertiser with a huge $100k budget. To top it off, the buyer will pre-pay $50k up front and promises net-15 payment terms.

The deal goes live… and within 24-hours exchanges shut you down and all of your publishers turn off their tags because for some strange reason all of their visitors are complaining that you are trying to install some sort of trojan/malware program with your ads

Yep, there’s bad guys out there that will pay you serious cash to run ads that are really viruses in disguise. When you load them from the office they behave. Enter night-time and they turn into nasty beasts that will cost you publisher relationships, a bad rap with Sandi and potential scrutiny from the feds.

General rule of thumb… if the deal is too good to be true, it probably is. Google has done a terrific job setting up a website to educate the industry about this on www.anti-malvertising.com. Make sure every single one of your sales & ops staff reads this entire site in detail.

#4 – Not Focusing on Sales

If you are building something that’s amazing & scientific, it’s probably the wrong thing to build. No seriously… If you have even one PhD on staff you’re probably doing something wrong.

Quarter after quarter at Right Media I’d work with a team of engineers to push out improvements & features to the optimization system to increase efficiency, ROI & spend. You’d think that in a business running several billion ads a day that this would be the single largest driver of company revenue. Yet… one sales guy at the original Right Media “Remix” Ad-Network single-handedly blew me out of the water one quarter with a single insertion order… and the deal didn’t even use optimization.

Relationships matter… a lot. Not every buyer out there just wants to buy into a magic black box that will auto-magically uber-optimize their life. Advertising is, believe it or not, about more than just clicks & conversions. There’s an inherent understanding of the target audience and the media and buyers want to work with companies that understand how they are thinking and who they are looking for. This means that the buyer wants to talk to someone he can relate to, who listens to him and who he can trust.

This is why every media startup needs a strong sales team. You might have the greatest technology in the world, but if you can’t sell it, it’s not going to get you far. The smart guy in the room? They’re the ones that hire the sales guy that will close the multi-million $ deal. [The above mentioned sales guy went to work for Invite Media, now of course a Google company...]

#5 – Over building technology

To some extent this is a follow-up on the previous point, but so many companies I talk to seriously over-build their technology. The market today is simple. Yes, we will definitely be in a world one day with “traders” sitting at terminals with tickers and fancy secondary future markets and involvement from some of Wall St’s finest…. just not today.

Today, one great trafficker/optimization analyst can beat almost any algorithm out there A team of 5 temps working for a week can apply categorizations to the top 1000 internet sites with similar accuracy to the fanciest semantic engine. A smart BD guy can buy KBB data w/out a deep API integration to a data exchange. A buying strategy of “remarketing” will out-perform any other campaign strategy or behavioral data by at least 10x.

Now don’t get me wrong… there is definitely a market for technology and technology is the only way in which you take the behaviors of brilliant individuals and scale them to be a hundred million $ business. Here’s the problem, most companies start by building technology, then trying to apply it. If you want to be a successful media business you should do the opposite. Hire some great people, watch how they operate, then build technology to automate what they do.

Conclusion…

The above 5 are common mistakes… but there’s one very simple rule of thumb any and every CEO, investor or board member can use to judge the quality of a media startup.

If you ain’t making money, you ain’t doing it right.

Seriously. More than 3 months old with 0 revenue? Likely to fail. Low revenue with high burn? Doomed to fail. The simple answer is it’s easy to get at least one agency to buy in as an early adopter and throw you some $ to “test”. If you can’t do this, you’re doing something wrong!

PS: Shameless self-promotional use of the blog here but… AppNexus is HIRING!!

I don’t care who you say you are, what do you DO?

May 3rd, 2009

One of the things that boggles my mind is how massively fragmented and confusing the display world still is. It’s been over three years since the first ad-exchange launched yet the world hasn’t significantly changed. What makes matters more confusing is that there is no consistent terminology to describe what a company does. It seems everybody describes themselves as either a platform, marketplace or exchange — so what’s the difference?

A company can call itself a publisher, an agency, a network, a broker, a marketplace, an exchange, an optimizer — what does it all mean? What’s the difference between Right Media and Contextweb? Admeld and Rubicon? That’s really the problem — today’s commonly used labels are useless.

Instead of evaluating a company based on labels, evaluate it based on the services it provides, technology it has, the partners it works with, the revenue model and the media revenue it facilitates. Note — below I focus entirely on companies that in some shape or form touch an *impression* — either as a technology provider, buyer or seller. There are peripheral companies that provide a whole world of supporting services, but I’m leaving those out for now to avoid confusion.

Services

Each company provides certain core services to partners, customers and vendors. These primarily center around the relationship the company has with the media that flows through it.

| Service | Description | Example | Implication |

|---|---|---|---|

| Selling of Owned & Operated Media | The company represents and sells media inventory that it owns. | Yahoo selling inventory on Yahoo Mail. New York Times selling it’s inventory |

Company’s sole objective is to maximize CPMs and revenue. |

| Arbitrage of Off-Network Media | The company resells media inventory that it acquires from other services. | Yahoo selling users on the newspaper consortium. Rubicon selling inventory from it’s network of publishers. |

Company takes arbitrage of the inventory which means that it’s incentivized to buy low and sell high to maximize it’s own revenue rather than that of the inventory owner or the advertiser. |

| Inventory or Advertiser Representation Services | The company helps inventory owners sell inventory at a fixed margin. | AdMeld serving as a direct rep for publishers remant X+1 managing all campaigns for a specific advertiser or agency |

Company is incentivized to maximize revenue for the inventory owner or ROI for the advertiser. |

| Data Aggregation | Company aggregates user data and resells it | BlueKai’s data exchange Exelate’s data marketplace |

Company hates Safari and IE8 |

Technologies

There are certain core technologies that define what a company does. Note that you will find technologies such as dynamic creative optimization, behavioral classification and contextualization missing from the below list as they are differentiators — they don’t define what a company does but provide a competitive advantage over the competition.

| Technology | Description | Example | Implication |

|---|---|---|---|

| Internally available adserver | Company has a proprietary in-house adserving system. | Specific Media has it’s own proprietary adserving technology that it uses to manage it’s network. | Company sees technology as a competitive asset against competitors. |

| Externally available adserver | An adserver that the company licenses (either free or paid) to third party companies to manage their own online media. | OpenX providing their hosted adserver to publishers Invite Media’s cross-exchange Bid Manager platform Google’s Ad Manager |

Multiple companies using the same platform provides both aggregation and consolidation opportunities. Technology in this case helps build an open platform (since everyone has access). |

| Internal Trading | Inventory run through the externally available adserver can be bought and sold internally | Google’s AdEx allows multiple participants to use the externally available adserver to buy and sell media. Right Media’s NMX customers can buy and sell media to each-other directly. |

There is a network effect related to the size of the platform. The more participants the more value there is for everybody involved. |

| Buying APIs | Company provides an API, either real-time or non, through which buyers can upload creatives and manage campaigns. | Right Media allows it’s customers to traffic line items and creatives using it’s APIs. | Company is empowering buyers to be smarter by enabling deeper integration across platforms. The stronger the APIs, the more the buyers can spend. |

| Selling API | Company provides a real-time API through which sellers can ask in real-time how much company is willing to pay for an impression. | Right Media and Advertising.com respond in real-time to a ‘get-price’ request from Fox Interactive Media’s auction technology | Company can value inventory in real-time. |

Size Matters

Last but not least, the size and the partnerships of a company matters. I’ve written before about the perils of building technology in a void. You can have the most amazing platform that provides great services, but if you’re only running a few thousand dollars a month it’s all moot in the grand scheme of things.

Size can be measured either in impressions or revenue, the latter being far more telling. Getting a billion impressions of traffic a day isn’t hard these days — between Facebook and Myspace alone you probably have close to fifteen billion impressions of traffic running daily.

There’s a huge difference between a partnership and a media relationship. If you’re willing to foot the minimum monthly bill, anybody can buy Yahoo’s inventory through the Right Media platform. That doesn’t say much about who you are as a company. A partnership is different — it might be deep API integrations tying two platforms together or co-selling and marketing a joint solution.

What does it all mean?

Phew… that was a long list, so what does it all mean? Well, the above provides a slightly less fuzzy framework than the classical “ad-network”, “marketplace” or “exchange” commonly used labels to describe a company. Let’s look at a few examples:

Rubicon Project provides publisher representation services through it’s network optimization platform, arbitrages inventory through it’s internal sales team has both an internal and has an externally available adserver (one for the sales team and one for publishers) and is rumored to be working on real time buying APIs. That’s a hell of a lot more descriptive than “publisher aggregator” or “network optimizer”. The one thing I always find confusing about rubicon is that it their incentives seem to be fundamentally misaligned. How can you both arbitrage inventory and serve as a publisher representative? Updated (5/3/09 @ 8pm EST) — I seem to be misinformed. Per comments, Rubicon does not sell inventory directly to agencies.

Compare this to AdMeld which provides publisher representation services through it’s network optimization platform — an externally available adserver — and provides buying APIs (currently via passback). So what’s the difference with Rubicon? Well, one has an internal ad-network and the other doesn’t — different incentives. Publishers are starting to treat Rubicon as another ad-network in the daisy chain whereas AdMeld sells all remnant inventory as a trusted partner.

ContextWeb has an internal adserver (with a self-service interface… I don’t count that as external), they arbitrage inventory, and provide buying APIs. Compare this to Right Media which has an externally available adserver, buying and selling APIs, internal trading, data aggregation and arbitrages media (through BlueLithium/Yahoo Network). Both are “exchanges”, but clearly there is a pretty big difference between the two!

Of course if you get to Google your mind starts to explode just a little bit — as they do everything. Seriously. They buy & sell, have multiple adservers, provide buying APIs, internal trading, data aggregation…

Final Thoughts

I hope this post has given you some ways to start thinking about companies in the online ad space. I’d love to hear your feedback in the comments — what core services & technologies am I missing?

Now — next time someone says — “I’m an exchange”, why not ask — “Ok, that’s great, but what do you really do.”

Advertise less, make more money!

December 15th, 2008

Yahoo Research via Geeking with Greg:

In Web advertising it is acceptable, and occasionally even desirable, not to show any [ads] if no “good” [ads] are available. If no ads are relevant to the user’s interests, then showing irrelevant ads should be avoided since they impair the user experience [and] … may drive users away or “train” them to ignore ads.

What a crazy idea — what if one were to actually make more money by not advertising. It makes total sense. We’re inundated with media. Our eyes have been trained to ignore those lovely 160×600 and 300×250 size objects that we see all over our web pages — especially on social networking sites where our users spend so much time.

This fascinating paper on negative externalities further reinforces this idea:

Most models for online advertising assume that an advertiser’s value from winning an ad auction [...] is independent of other advertisements served alongside it in the same session. This ignores an important externality effect: as the advertising audience has a limited attention span, a high-quality ad on a page can detract attention from other ads on the same page.

I’m sure everyone by now is familiar with Pareto’s law — otherwise known as the 80/20 rule. Applied to advertising Pareto’s law states that 20% of impressions generate 80% of the revenue — and yes this is true for most web 2.0 properties that I have worked with. So what if we stopped showing ads on the 80% that were only generating 20% of the revenue?

Instead of showing crappy CPA offers the publisher should show either nothing at all, or some relevant site content. Show a snippet of the friend-feed, or maybe a list of ‘online friends’. Show “interesting related links”, or “new photos posted”… it doesn’t really matter. Show something that is of interest to the user. The point of the exercise is to train the user to start looking at this specific space again.

In the short term this may very well sacrifice 20% of revenue, as users who were previously inundated with ads are learning to trust those slots again. Longer term we get more user engagement which means higher rates on the other 80% of revenue. I wouldn’t be surprised if you saw a 50% increase in engagement just by showing 80% fewer ads — and that increase in engagement translates directly to higher rates and a fatter bottom line.

There are a world of other benefits too. First of all — fewer ads means happier users. It also means fewer creative issues (whether content or malvertising). The publisher can also use this as an opportunity to drive traffic from lower to higher monetized sections of the site. Eg, Myspace could drive users from the low $0.15 CPM User-Generated Content pages over to the very brandable ‘Movies’ section. And last but not least — showing fewer ads will create a sense of scarcity around what today is most certainly considered “bulk” inventory. This scarcity will help justify higher rates on the premium guaranteed buys — further helping to fatten up that bottom line.

If this is obviously so good, why is nobody doing it? Well there’s only one small insignificant problem… Publishers have no way of identifying the top 20% of impressions. You see, especially on social networking sites a huge portion of that 20% are impressions that are sold behaviorally via ad-networks and exchanges. Those ad-networks and exchanges need to see the full 100% to be able to cherry-pick the 10% that are valuable to them thereby making it quite difficult for the publisher to “not show ads” on worthless impressions. In fact, since all reporting is aggregated, most publishers don’t even realize that the majority of their revenue comes from a relatively small # of impressions.

How do we get around this? Well… that’s another blog post =).

Introducing “buy side” versus “sell side”

December 10th, 2008

In my last post I said that the traditional ad network model was dying — what I didn’t talk about is how I think the network model will evolve over the coming years.

The fundamental flaw with the traditional network model is that the network is incentivized to optimize it’s own revenue — not maximize value for the advertiser. As long as you keep the advertiser happy that he’s getting a great ROI, and the publisher gets his paycheck — the network can keep the rest. The less demanding the advertiser, the less intelligent the advertiser — the better for the network!

Let’s take a simple example — A classic agency IO line item has a size, cpm, budget and some basic targeting parameters and goals. For example, one agency may buy $10,000 worth of US based inventory at a $0.50 CPM for 728x90s with a target CTR of 0.5%. Another way to think about this is that $10,000 @ $0.50 is 20M impressions, and at a 0.5% CTR means the agency is expecting to receive 100,000 clicks.

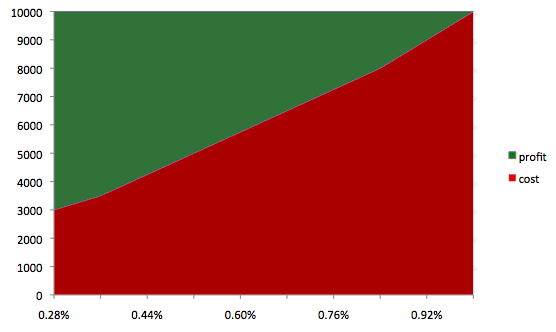

Now the smart network will go out and see how cheap he can go and acquire 100k clicks on news inventory. Why? Well, assuming he can deliver the volume his revenue has already been fixed — it’s $10,000 no matter what he does. The only thing on the line is whether or not this IO will be renewed or expanded next quarter. Since cost is the only variable the network can manipulate to increase profit he will go out and find the cheapest possible inventory that at least a 0.5% click through rate. The chart below demonstrates this with fictitious data. Buying cheaper inventory results in a lower CTR, but also significantly higher profits. All the network has to do is figure out how happy he wants to make the advertiser — just happy enough to renew (and maybe increase) next quarter’s IO, but not quite enough to cut into his healthy profit margin.

Network Profit & Cost w/ Campaign Performance

Now you might think that this only works if advertisers are buying on a CPM, but sadly that is not the case. Whether it’s on a CPC, or even a CPA — it’s all about finding the cheapest way to fill the requirements. You see, there is actually a strong difference in lead-value depending on the source of the inventory. A click from Yahoo’s homepage is actually worth significantly more than a click from a social networking site such as Myspace or Facebook. Similarly, a lead or conversion from the New York Times (one of the most affluent properties on the web) is worth more than a conversion from helpforhomeowners.org. The majority of buyers out there today do not have the necessary lead tracking tools to accurately identify who is sending them good or bad leads.

I think that it’s this fact alone that justifies the need for central exchanges — which charge transparent fees to connect buyers and sellers. The problem with exchanges is that most agencies lack the deep buying knowledge that the ad-networks have. Just because there direct access to billions of impressions per day doesn’t mean that anybody *can* just buy them effectively. It takes serious skill and agencies still need help finding the inventory that will work best for their campaigns.

It is here that we are starting to see a new breed of ‘network’ — 100% advertiser focused buying networks that put their interest squarely with the actual agency. By charging transparent fees (say 10-20%) and being open about the inventory they buy — the agency can trust that efforts are spent optimizing and acquiring the best possible inventory for each campaign — not the cheapest that will fulfill the actual requirements.

Yet there is also a longevity question. Although agencies lack the skills to buy effectively today, this is something that they are all working on — at what point does the agency become a competitor of the “buy side” network — and visa versa? Logically these business don’t need to be separate, but practically I wouldn’t be surprised if they remain that way. Agencies are naturally filled with “right brain” people — they are creative, imaginative. Networks are naturally “left brain” focused — analytical.

Next post — we’ll take a look at the publisher rep firms and their growing role over the coming years.

The World is a’ Changing

November 10th, 2008

Unless you’ve been living under a rock somewhere you’ve probably heard that the whole world is crumbling around us. We’re entering the great depression, guard your cash, no more VC, we’re all POOR.

Well, first let me reassure you — so far the nuclear winter hasn’t started yet. The data that exists so far has been fairly sparse and inconclusive — Google is up, AOL is down… Rubicon claims the sky isn’t falling whereas PubMatic claims prices are steadily falling. I’ve had quite a few in depth discussions over the past few weeks on exactly this topic — where is the industry headed? How is the economic downturn affecting online advertising? What are the big boys doing? What’s new exciting?

Last week’s AdECN announcement and a short stroll through the booths at AdTech finally motivated me to get up and write another blog post! (sorry for my absence, life is pretty hectic these days). So here goes in no particular order my views of exciting things in the market today and what’s coming next.

The traditional “marketplace” network model is dead

By traditional networks I mean the models that ValueClick, Casale and Ad.com were founded on — networks that were primarily built by matching large amounts of supply and demand. The name of the game was to get as many advertisers and publishers together as possible to build the largest marketplace. Once the network was large enough, ad dollars naturally flowed to these players as they were a “one stop shop” for thousands of publishers. Large margins are made by buying low and selling inventory to advertisers at a higher price.

This model was used by many companies to build incredibly successful networks — and in fact — most of these networks are *still* very successful. The problem is, the world is changing. Namely:

First, access to inventory is no longer a competitive advantage. Between Exchanges, publisher aggregators and a mass influx of social networking inventory — everybody has access to billions of impressions.

Second, agencies want to cut out the middle man. Agencies have started to realize that networks are taking massive cuts out of their media buys while in many cases simply serving as an aggregator. And indeed, with supply easier and easier to get access to, many agencies are launching initiatives to cut out the middle man. Whether it’s the new Havas Artemis system, the Publicis Vivaki network or the WPP 24/7 acquisition — they’re all moving in the same direction.

Essentially — networks are getting pressure from both sides. On the supply side they are getting commoditized by aggregators and network optimizers and on the demand side a new crop of technology companies is attempting to empower agencies to buy directly — cutting off the ‘marketplace’ networks.

The rise of the pubgregatimizer

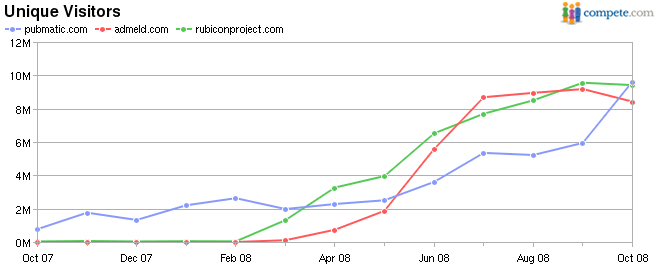

Publishers have finally realized that they might not be the best ones to sell their non-guaranteed inventory. Three well funded companies have emerged that are looking to help publishers navigate the sea of ad-networks and best monetize — PubMatic, Rubicon and AdMeld. I think the value prop is obvious — only the largest of publishers can afford the staff to fully manage the distribution of remnant inventory across various networks. At the moment it looks like the three are neck & neck in terms of unique visitors:

Decreased growth rate will force more accountability for agencies

Although the sky isn’t falling, money is getting scarcer. This scarcity will force everyone along the entire value-chain to be more competitive. This will start with the agencies and go all the way to the publisher — everyone will have to prove both effectiveness and figure out new ways to differentiate themselves from others. Scarcity of dollars will also put pressure on agency margins forcing them to look elsewhere on ways to increase their revenues.

Some initiatives have already started here — Publicis has launched Vivaki, WPP bought 24/7 and Havas has Artemis. Although the exact strategies are vague, one thing is clear — Agencies are going to start getting more involved in the buying process as they see their margins drop to 10% or below whereas our traditional networks (dying per the above) are still pulling in 30-50% margins on their media.

The challenge here is that most agencies aren’t setup to buy effectively online. Buying online is much more about technology, analytics & strategy than it is about creativity, ingenuity and imagination. To buy effectively online an agency needs to start working on it’s brain — which of course is currently largely dominated by “right brain” creative folks and lacking in “left brain” analytics. One of the things we see here as an increase in popularity of the ‘media trading experts’ — networks that focus exclusively on helping agencies buy the best possible media for their clients. Leveraging exchanges & aggregators instead of traditional ties to publishers these networks can serve as an unbiased agent of the agency.

Exchanges will move to real-time integration

Even though only one has made it public — AOL, Yahoo, Microsoft & Google are all working on real-time integrations. Why? Any central trading platform for media needs to support different engines & algorithms. If nobody can differentiate themselves on a platform, then nobody will want to use said platform! Although Right Media was a terrific step forward as the first central trading platform, it’s major flaw is that it took the technology out of the network. Real time bidding platforms solve that by allowing smart advertisers & networks to run their own engines. With the big 4 all working on something… it’s going to be interesting to watch what happens!

This combined with all of the above show a great picture for technology focused ad networks. As I wrote about earlier here and here — it is the difficulty of integration that has limited many an online ad technology startup from succeeding. With supply becoming more and more available in more and more programmatic manners — a time is coming when the guy with the best algorithm will actually stand a chance competing against the guy with the best relationships at WPP.

Final Thoughts

This is an incredibly exciting time in the industry — the whole industry is fragmented, there is little standardization and there is a massive amount of pain. I think big changes are coming. I’ll try my best to be a little more prompt about blogging about it while it happens

Also — if anybody is going to be at Adrevenue 08 and wants to meet up, shoot me a note.

Good post on data-flows and affiliate marketing

July 14th, 2008

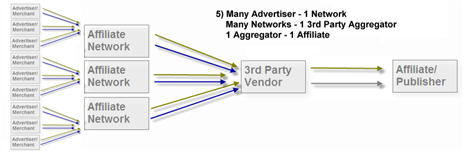

This post by Carsten Cumbrowski on data-flow in affiliate marketing gives some good insight into the inefficiencies of the affiliate marketing world. The diagrams (see below) look very similar to display — too many tiers of aggregators primarily dealing with massive segregation, lack of standards and inefficiencies.

Are you generating revenue?

July 1st, 2008

A few weeks ago I wrote a post about the difficult times that tech startups are having in the industry today. Reading through the post, I realized there was a key point that I forgot to make. Whether or not your company is a services business, a technology play or a media company:

If you aren’t generating revenue, it’s time to re-evaluate your business.

There is so much VC money out there these days (although word on the street is it’s drying up!), that it’s easy to forgo initial revenue and start building & scaling a business in a void without having hard cash paying customers. Here’s the thing — you should be able to prove your technology quickly and with minimal investment… if you can’t, you’re overthinking either your product or overestimating the requirements of your clients. In fact, with the right contacts you can probably sell a 20-line PHP script as a “pixel server” — at least to a network or agency that desperately needs to have “behavioral technology” for the next big agency deal.

Of course the script won’t scale, and it probably won’t work as a standalone product for multiple customers which means you’ll have to rewrite it and hire some real engineering talent to turn it into a packageable product. But if you have an idea — build a POC quickly, get yourself a customer, prove there’s interest and start generating revenue! Doesn’t matter if it’s adserver, behavioral tracking, a new media network — each idea has a revenue-generating “quick win” you can close to prove the business works. Right Media was a profitable for over a year before it launched the exchange. A single good CPA deal with AOL funded most of the first year of the company!

And it’s not just about the revenue. Real customers provide real data, real feedback and real stats about scalability & performance — invaluable feedback & information that will help you build a better and ultimately more competitive final product and/or service offering.

I’m not saying you have to be profitable (although if you’re a pure media company you better have a damn good reason not to be). There is definitely an argument to be made that investing in engineering today will pay off in revenues later, but that does not give you an excuse to develop in a void hoping that your product will be a smash hit.

If you’re not making money now, chances are you won’t make any later either.

Industry starved for data?

May 14th, 2008

PubMatic just released a new AdPrice Index which was immediately picked up by a rather frightening number of news sources: Business Week, ClickZ, The Washington Post to name just a few.

First off, serious kudos to the PubMatic team for releasing these numbers. This post is in no way meant to be negative to them, they’ve got a great service and by releasing this index they are upping the bar for everybody else — I wish everybody released a monthly report indicating their view of the market. Note that Rubicon had previously released a less statistical and more narrative Q1 Ad Network Market Report.

What I find somewhat surprising is the level of buzz the PubMatic release generated. Although I’m certain that the statistical quality of their numbers is good I want to point out that there is an inherent sample bias for the Index not only on the publishers selected but also the ad-inventory being analyzed. The publishers are ones that chose to signup for the PubMatic service to help them optimize revenue from Ad Networks. Next, PubMatic’s numbers reflect only the subset of inventory that was sent to PubMatic and the media dollars that inventory made based on the networks that work with PubMatic’s platform.

So even taking these numbers with a grain of salt there are probably enough pubs & networks that something happened in April… so surely it must be time to PANIC because we’re in this massive recession and online advertising is going to dry up and die … right?

Well, I’ll let you in on a little secret. Agencies have quarterly budgets. Each ad-campaign has a certain target revenue that needs to be spent by the end of the quarter, and since most publisher forecasting systems are prone to error there are a large # of campaigns that find that their guaranteed buys have under-delivered and are now nearing the end of the quarter with significant money left to spend. Where do they go? Ad-Networks. Through years at RM we saw the same thing year after year, quarter after quarter. March, June, September and December were always high in revenue, with December being particularly great with some nice “end of year” budgets moving to remnant display. So my guess — what we’re seeing is a normal cyclical trend, where Q1 budgets moved to Ad-Networks in March, disappeared in April and hence PubMatic saw a significant drop in revenue. Of course I could be wrong, but either way the media should certainly stop predicting the impending doom of the online-ad market.

More important than the actual numbers, I think that the reaction to this event shows how desperate we are for insight and visibility into what’s going on. How much money is flowing, and to which parties? What I’d like to see is the Quantcast 100 Advertising Index. Impressions, CPMs & revenue for the aggregate top-100 sites on the Net — now those would be numbers to analyze and report on!

The Facebook API revolution

September 25th, 2007

No, this isn’t another “OMG, the facebook API IS AWESOME” post. I mean, it is, it’s pretty damn cool, I’ve played with it a bit this month. The real revolution with the facebook API are the server-side requests.

Traditionally widgets & plugins interfaced with social networks by placing snippets of HTML on profile pages. In the Facebook world no content can show up on a user’s profile without passing through Facebook’s servers first. Even your actual application pages must either be within an IFRAME or pass through Facebook. This process provides Facebook with an extraordinary level of control over what can and cannot be displayed on a user’s page. FB can perform a virus scan on all content and analyze any scripts for vulnerabilities or exploits. By directly serving content Facebook also eliminates cookie access — making it far more difficult to track or distribute data about their users.

Yet, the approach has it’s limitations for application developers. I tried briefly to build a “stalker tracker” application which using cookies would tell the user how many people regularly checkout their profile page. No matter what I tried, I couldn’t get access to the cookie without somehow initiating a click — rendering my application completely useless.

Why should you care? Well — advertising isn’t that much different from a traditional social networking widget — both are delivered via a snippet of HTML. Online ads have also been plagued by security issues this past year and I wouldn’t be surprised if the bigger players (Myspace, Yahoo, MSN, etc.) start to ask for server-side ad-requests soon. Server-side requests are the only way that a seller can technically guarantee the safety of third-party ads. Of course this will open up a world of technical challenges — server-side cookies storage, strict global latency requirements and a need for increased capacity to only name a few.