Google’s new 2009 display project

December 15th, 2008

Did the title get you? Honestly… I have no clue. I’ve heard some whacked out rumors — a new exchange, retiring dfp, building the uber-network of all uber-networks, taking over the world… Almost every conversation I’ve had in the last 2 months the big G has come up — what are they doing? They have all the strategic assets necessary to dominate display.. but aren’t. Why? Talent drain? Bad strategy? Who knows?

I imagine of all my blog readers have all heard small nuggets and rumors ideas floating around. This post is an open invitation to post what you know (be as anonymous as you like). No slander… and if you’re going to make something up at least make it so ridiculous nobody will believe you. Maybe collectively we can figure out what’s the behemoth is going to do.

PS: You can subscribe to the comment feed here. Don’t worry — I disabled commenting on my URL History post so the spam there has stopped.

The World is a’ Changing

November 10th, 2008

Unless you’ve been living under a rock somewhere you’ve probably heard that the whole world is crumbling around us. We’re entering the great depression, guard your cash, no more VC, we’re all POOR.

Well, first let me reassure you — so far the nuclear winter hasn’t started yet. The data that exists so far has been fairly sparse and inconclusive — Google is up, AOL is down… Rubicon claims the sky isn’t falling whereas PubMatic claims prices are steadily falling. I’ve had quite a few in depth discussions over the past few weeks on exactly this topic — where is the industry headed? How is the economic downturn affecting online advertising? What are the big boys doing? What’s new exciting?

Last week’s AdECN announcement and a short stroll through the booths at AdTech finally motivated me to get up and write another blog post! (sorry for my absence, life is pretty hectic these days). So here goes in no particular order my views of exciting things in the market today and what’s coming next.

The traditional “marketplace” network model is dead

By traditional networks I mean the models that ValueClick, Casale and Ad.com were founded on — networks that were primarily built by matching large amounts of supply and demand. The name of the game was to get as many advertisers and publishers together as possible to build the largest marketplace. Once the network was large enough, ad dollars naturally flowed to these players as they were a “one stop shop” for thousands of publishers. Large margins are made by buying low and selling inventory to advertisers at a higher price.

This model was used by many companies to build incredibly successful networks — and in fact — most of these networks are *still* very successful. The problem is, the world is changing. Namely:

First, access to inventory is no longer a competitive advantage. Between Exchanges, publisher aggregators and a mass influx of social networking inventory — everybody has access to billions of impressions.

Second, agencies want to cut out the middle man. Agencies have started to realize that networks are taking massive cuts out of their media buys while in many cases simply serving as an aggregator. And indeed, with supply easier and easier to get access to, many agencies are launching initiatives to cut out the middle man. Whether it’s the new Havas Artemis system, the Publicis Vivaki network or the WPP 24/7 acquisition — they’re all moving in the same direction.

Essentially — networks are getting pressure from both sides. On the supply side they are getting commoditized by aggregators and network optimizers and on the demand side a new crop of technology companies is attempting to empower agencies to buy directly — cutting off the ‘marketplace’ networks.

The rise of the pubgregatimizer

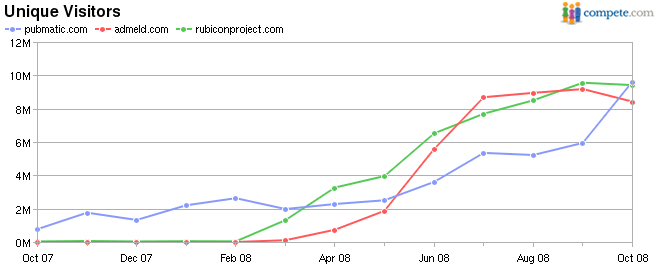

Publishers have finally realized that they might not be the best ones to sell their non-guaranteed inventory. Three well funded companies have emerged that are looking to help publishers navigate the sea of ad-networks and best monetize — PubMatic, Rubicon and AdMeld. I think the value prop is obvious — only the largest of publishers can afford the staff to fully manage the distribution of remnant inventory across various networks. At the moment it looks like the three are neck & neck in terms of unique visitors:

Decreased growth rate will force more accountability for agencies

Although the sky isn’t falling, money is getting scarcer. This scarcity will force everyone along the entire value-chain to be more competitive. This will start with the agencies and go all the way to the publisher — everyone will have to prove both effectiveness and figure out new ways to differentiate themselves from others. Scarcity of dollars will also put pressure on agency margins forcing them to look elsewhere on ways to increase their revenues.

Some initiatives have already started here — Publicis has launched Vivaki, WPP bought 24/7 and Havas has Artemis. Although the exact strategies are vague, one thing is clear — Agencies are going to start getting more involved in the buying process as they see their margins drop to 10% or below whereas our traditional networks (dying per the above) are still pulling in 30-50% margins on their media.

The challenge here is that most agencies aren’t setup to buy effectively online. Buying online is much more about technology, analytics & strategy than it is about creativity, ingenuity and imagination. To buy effectively online an agency needs to start working on it’s brain — which of course is currently largely dominated by “right brain” creative folks and lacking in “left brain” analytics. One of the things we see here as an increase in popularity of the ‘media trading experts’ — networks that focus exclusively on helping agencies buy the best possible media for their clients. Leveraging exchanges & aggregators instead of traditional ties to publishers these networks can serve as an unbiased agent of the agency.

Exchanges will move to real-time integration

Even though only one has made it public — AOL, Yahoo, Microsoft & Google are all working on real-time integrations. Why? Any central trading platform for media needs to support different engines & algorithms. If nobody can differentiate themselves on a platform, then nobody will want to use said platform! Although Right Media was a terrific step forward as the first central trading platform, it’s major flaw is that it took the technology out of the network. Real time bidding platforms solve that by allowing smart advertisers & networks to run their own engines. With the big 4 all working on something… it’s going to be interesting to watch what happens!

This combined with all of the above show a great picture for technology focused ad networks. As I wrote about earlier here and here — it is the difficulty of integration that has limited many an online ad technology startup from succeeding. With supply becoming more and more available in more and more programmatic manners — a time is coming when the guy with the best algorithm will actually stand a chance competing against the guy with the best relationships at WPP.

Final Thoughts

This is an incredibly exciting time in the industry — the whole industry is fragmented, there is little standardization and there is a massive amount of pain. I think big changes are coming. I’ll try my best to be a little more prompt about blogging about it while it happens

Also — if anybody is going to be at Adrevenue 08 and wants to meet up, shoot me a note.

Quality Matters!

September 16th, 2008

Ads being shown by Google Adsense on Recent Posts:

|

|

|

|

Here’s the problem — I don’t really care how much money I make from advertising on this blog — I care far more about it’s reputation, which of course reflects on my personal reputation. Now I have nothing against display ads — in fact I have spent quite a bit of time optimizing themselves, but give me a filter. Why is it that adsense only gives publishers the option to either “show display” or “do not display”. Give me a “recognized brands only” button! Let me filter out these crappy ads! Let me select advertisers who I will allow to show display ads… give me control!

Thankfully for the rest of us, Google still has a bit to learn about display! In the meantime, I’m switching back to text ads only.

Mashable/Google/Malvertising Follow-Up

August 20th, 2008

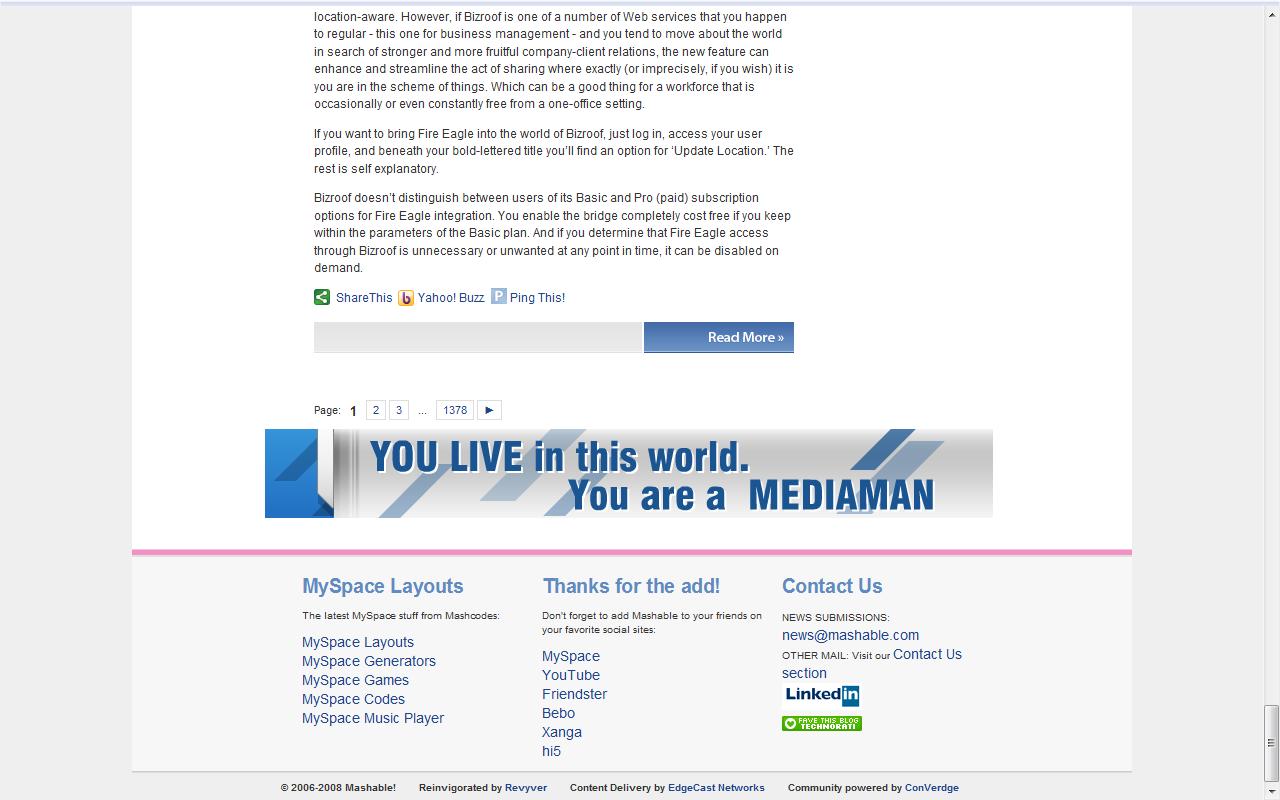

First off — the ad is still showing. If someone has a contact @ Mashable, it’d be good to send them a note.

Greg Yardley thinks that this ad is not served by the Adsense network but instead by Mashable’s internal salesforce and that they are simply using Google’s new AdManager product as their adserving solution. Digging through the tags, it’s unclear whether or not this is the case. The actual creative is hosted on the domain “pagead2.googlesyndication.com” which has traditionally been used to host Adsense creatives and ad tags. Google’s AdManager runs on a different domain — “partner.googleadservices.com” — but it is certainly possible that AdManager and AdSense share the same underlying static content delivery system. (someone from Google care to comment?)

This is an excellent example of the fact that URLs generally don’t provide enough information to identify who is delivering the actual advertisement on the page. In this Mashable/Google page, it is unclear — it could be Mashable’s internal salesforce selling the ad — or there could be some server-side integration between AdManager and Adsense and Adsense is responsible for serving this actual creative. Right Media suffered from many of the same problems — people would always yell at the Right Media Ad-Network whenever a creative hosted at content.yieldmanager.com was causing problems, even though that single domain was shared across 50+ networks.

The solution that we came up with @ RM was to start using DNS CNAME aliases when returning any and all content. A CNAME is a simple DNS record that simply says — “this domain name is an alias for this other domain name”. So for example, the domain “content.cpxinteractive.com” is an alias for “content.yieldmanager.com”. This way, if CPX was responsible for serving a bad ad the offending URL would be “content.cpxinteractive.com/ad.jpg” and not “ad.yieldmanager.com/ad.jpg”. CNAMEs allow central serving systems (eg, AdManager) to both hand out tags and return creative content tagged with an owner while still maintaining the same internal systems.

Google Adsense showing Malvertisements

August 19th, 2008

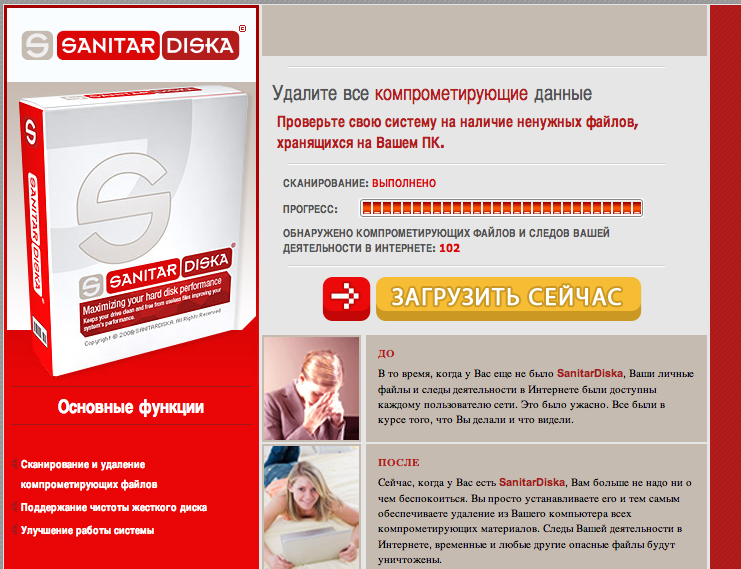

Matt Cannon sent this one over to me yesterday afternoon. He saw Google showing this lovely ad for MediaMan on mashable.com at about 1pm EST. MediaMan has been identified a long time ago as a malvertisement so it’s a surprise to see them popping up on the Adsense network. Details are below. Now I’m not posting this to shame Google (I’m sure their content team has already pulled this ad) — I’m posting this more as a call to action. It’s time that we start grouping together as an industry to help stop this. More thoughts coming on that shortly.

Screengrab of ad on Mashable:

Source of the ad (warning I would not open this if I were you):

http://pagead2.googlesyndication.com/pagead/imgad?id=CLK8lreVvKyciwEQ2AUYWjIIqyqX6hvFaHc

Screengrab of the ad:

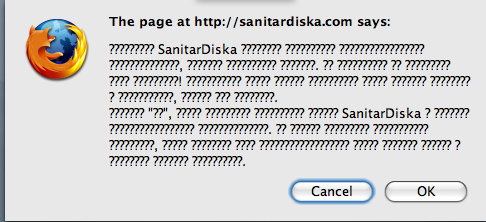

And for the first time in a while (probably because I’m in Moscow!) I actually got the actual trigger, and got this nice popup:

and was redirected to this lovely landing page:

Is Google taking behavioral data to display?

July 18th, 2008

I was just browsing on my gender test blog post and noticed the following ad:

So normally you’d say — so what mike, it’s just an ad for senseo! Well this ad is special because I was just searching for Senseo coffee pods earlyt his morning (both via Google & Amazon.com). I find it highly unlikely that this is a pure coincidence. Here’s the clickstream (broken into multiple lines and shortened for legibility):

http://pagead2.googlesyndication.com/pagead/adclick?sa=L&ai=BSrzSV[...] http://www.sharesenseo.com/index.jsp?q=a-googlewomen

Funny that there is a nice “q=a-googlewomen” inserted into the landing page — I swear the gender test showed me to be a man!! So this is all purely speculative of course, but if this is indeed true then we suddenly have the world’s best behavioral display network to compete with.

Don’t forget about Myspace

November 29th, 2007

Ok, so first off — I think I’m back to blogging. I needed a little break after leaving Yahoo, starting new things, but I’ve had a lot of interesting conversations in the past few months and some interesting new thoughts about the industry & life in general.

I know this is somewhat unrelated to advertising, but Andrew Chen motivated me with a great post on why Myspace is still more popular than facebook. I’ve thougth about this a bit as well and agree that Silicon Valley people simply aren’t Myspace people. I’m not one either, I hate the fact that it’s so ugly and unstructured — but as Andrew points out, we’re not like the rest of the world. I also don’t like NASCAR, Oprah or Self-Help books, but each of those are billion dollar markets.

So I thought I’d throw out a couple other reasons why Silicon Valley should stop hyping Facebook for a few minutes and take another look at myspace:

Myspace has had full unhindered third party functionality for years

Facebook apps are great, but by being so incredibly structured they are also incredibly limiting whereas on Myspace non-limited third party apps have been a possibility for years. I can place any HTML on my myspace profile, which means I can embed any sort of dynamic third party content. Sure there are some security concerns, profiles get hacked and all that fun stuff, but users don’t care. This super simple method of allowing third party developers to provide applications for Myspace users in many ways works much better than the very structured Facebook App.

Myspace has built a solid behavioral ad-targeting platform

While Facebook is getting hammered in the press for their “Beacon” product, Myspace quietly, and with no complaints has rolled out a new behavioral platform based on their SDC acquisition earlier this year. They just recently announced that the “FIM Serve” platform will power the rest of Fox Interactive Media’s properties as well.

Considering it’s been less than a year I think this is a rather impressive feat. Building a massively scalable ad targeting platform isn’t easy. Myspace also managed to do it in a way that didn’t piss off it’s users, and with minimal negative press.

Myspace didn’t waste time building a CPC ad platform

Look, lets all admit it, Google is the best at CPC, contextual & all that fun stuff. Everybody tries, but nobody can even come close. So while Myspace goes off and signs a $900 million deal with Google, Facebook builds it’s own platform. Combine the Myspace search & cpc deal with the behavioral ad platform and there’s a solid revenue generating strategy.

Where’s Facebook? Microsoft reps their ad-inventory (and word on the street they’re losing money on this), they don’t have a search partner and have built their own CPC engine which from what I’ve heard isn’t that good.

Myspace makes money

Lots of it. It’s hard to find accurate numbers out there, but estimates lie in the $500-700m for 2007. I can’t find a reliable source, and it’s hard to tell now that Myspace has been acquired by News corp, but they’re supposedly quite profitable. In the meantime Facebook with all it’s hype is getting $15 billion valuations, and raising money to help their own cash flow.

Building for the sake of building

In the end, the big difference between Myspace and Facebook is that one is a technology company, and the other is large social network. Silicon Valley loves the tech company, but this is a great lesson that a lot of companies in the ad-space should consider as well. It’s generally not the best technology that wins — it’s the one that solves the right problem. Your end users will often not care whether you did that elegantly or not, they will care that it works.

Facebook clearly has the better technology. The Facebook platform is fast, elegant, and chock-full of features. Even so, the ugly Myspace page with an IFRAME on it manages to both attract more users and provide a better feature set. I myself may not like it, but then again I’m one of the few people who appreciates the elegant execution on the technology side, your average person does not.

Selling behavioral data in a multi-platform ad-industry

July 26th, 2007

Not too long ago I wrote a post One buyer, many cookies, now what?. In that post I promised that I would write about how buyers can best operate in the coming market with multiple platforms — and hence multiple cookies & adservers.

A quick refresher

In prior posts I have stressed the following:

- An exchange or ad platform, fundamentally an adserver

- Adserving is still tied to one cookie.

- Behavioral targeting is tied to knowledge about a user

- Knowledge about a user is stored in the cookie (whether as a unique user id or the actual data)

If that didn’t make sense — go read some of my older posts first.

Behavior is the future!

A single exchange with a single cookie space would have enabled true global internet wide behavioral targeting. Lets imagine I wanted to remarket to mikeonads.com users. All I would have had to do in a single platform market is add my visitors to one behavioral segment on one exchange and then place buys on that segment. Sadly this is not likely to happen since the three major internet giants swooped in and acquired practically every adserving/exchange/marketplace up for grabs. So what would I do in a world with three platforms? Lets talk about some options.

Option #1: A global user-id

Imagine this — an independent entity that offers a global user-id database. Every marketplace, ad-network or exchange subscribes to this UID service and syncs their user-ids with the global user-id. So even though Google might think that you are user #12345 and Yahoo might think you are user 54321, I can use global UID database to map your mikeonads UserID of #164 to Yahoo’s 54321 and Google’s 12345. I then simply signal to Yahoo that user 54321 is a mikeonads.com user and similarly to Google. Now each exchange knows who my users are and theoretically I can then target campaigns to my users.

Chances of this happening? Pretty close to nill. First off you’d need an independent company to provide the global UID space because none of the giants would want to give up control to another on this front. Then this conglomerate would have to get past scrutiny from the FTC, FCC, FBI, CIA and who knows who else before being able to launch, and then finally somehow convince end users, who would have probably gotten wind of this from all the press coverage, that this wouldn’t be an invasion of privacy.

Option #2: Massive user-segment mapping

In theory this solution isn’t too different from the above except that it requires browser-side communication of segments. Instead of having a global user database which allows companies to merge and map their data you simply signal each individual piece of information to each platform. If I were Revenue Science, Exelate or Tacoda I could sign up with Google, Yahoo & any other source of supply and set up my user category mapping in each system. Then, when I decide whether to add a user to a segment I fire off pixels (or whatever method to add a user to a segment) for each system.

Lets go back to remarketing to mikeonads.com users. Some people might find this a little confusing, so I made a little diagram:

Lets walk through the steps (btw, this is hypothetical, I’m not actually tracking you like this!)

- You come to mikeonads.com

- The html for the site contains three img tags that point to various platforms

- Your browser loads the Google pixel

- Google updates it’s user database and adds info to your cookie

- Your browser loads the Yahoo pixel

- Yahoo updates it’s user database and adds info to your cookie

- etc.

Why does this have to work this way? Cookies! Each company has a different UID and each UID is stored in a cookie. For Yahoo or Google to store data on this user they must know who the user is, for which they need access to the cookie, which means the user’s browser has to request content from their servers.

The above is actually a perfectly feasible model and practiced a fair amount today. The problem is that it’s difficult to scale — sure if all I want to do is tell each platform that you visit my site it’s pretty easy. But what if I have thousands of different user segments and then have weights and scores on each?

Option #3:Tagging users based on value

Instead of building a mapping of a thousand different categories across five different platforms there is another solution — flagging users based on value. Lets say I rank my behavioral segments into ten different buckets, from very low to very high value — for example, users interested in credit-cards are far more valuable than users interested in harry potter. After having assigned a value priority I can then create ten different segments in each supply platform that I want to work with. Each time I have access to a user’s browser I fire off one of the ten segments to each of the supply platforms to signal the value I place on this user, much like option #2 above. Note that I still place the exact category in my own user database.

Once I have flagged users based on value I can then place a media-buy with each platform at different price points based on the ten user segments. For example, I can have one $5.00 CPM campaign for all the high value users, credit-card and auto buyers, and a $0.50 campaign for the less interesting behaviors — low-income family, under 18, etc.. Each time I win a campaign I have the platform redirect the user to my adserver where I pick my own ad to serve based on the exact categories that the user in. The major draw-back of this approach is that it forces third party adservers. To some extent this is inevitable but this is non-ideal from a creative review, discrepancy and user experience perspectives.

Final Thoughts

Even though the industry won’t be standardizing behind one platform there are several methods of enabling cross-marketplace behaviors. Obviously there are some privacy concerns that will have to be ironed out, but those are independent of the platform being used. Also, if you own a site and are interested in remarketing to your users in ways I describe above you should check out Advertising.com’s LeadBack service which allows you to do just that!

Yahoo v Google — Are times-a-changing?

July 18th, 2007

This morning a friend of mine pointed me to a paper titled Are Cover Stories Effective Contrarian Indicators?. The article is probably best summarized in the abstract:

Headlines from featured stories in Business Week, Fortune, and Forbes were collected for a 20-year period to determine whether positive stories are associated with superior future performance and negative stories are associated with inferior future performance for the featured company. “Superior” and “inferior” were determined in comparison with an index or another company in the same industry and of the same size. Statistical testing implied that positive stories generally indicate the end of superior performance and negative news generally indicates the end of poor performance.

Interesting right? Good cover stories on BusinessWeek and Forbes imply you won’t be doing well, whereas bad cover stories indicate change is coming! Ok, so lets look at Yahoo & Google.

In May of 2001, BusinessWeek published a story title Inside Yahoo! The untold story of how arrogance, infighting, and management missteps derailed one of the hottest companies on the Web. Clearly, not very positive. What happened to the stock? Stock hit rock bottom a few months after the article and within 2 years was double the price from the date of publication. You can see the carts here.

Ok, so of course that’s purely anecdotal and doesn’t mean much. But considering all the recent turmoil, I wouldn’t be surprised if we saw Yahoo on a cover soon as the “biggest screwup of all time”. You know what? How low can they go? Yahoo has some great assets and great talent. Sure, they’ve had some shitty leadership recently but it’s pretty clear that’s been changed.

In no way would I start buying stock based on this post (hey, there hasn’t been a negative cover story yet!), but I don’t expect Google to stay at the top for very long. When you’re the best it’s difficult to strive for more. And you know what? In April of this year, Google was featured rather positively in a cover story on businessweek titled Is Google Too Powerful? .

One buyer, many cookies, now what?

July 12th, 2007

Introduction

Back in March I wrote a post titled “Battle over the Cookie. I’m going to quote myself real quick — (I know, kind of tacky)

So why the title “Battle over the Cookie”? Well, people are starting to catch on that if they own the cookie, they own the market. Think about it, if one exchange succeeds in capturing a massive percentage of the market, the barriers to entry will be practically insurmountable. What value is your exchange if you can’t provide services like global frequency caps, cross publisher behavioral targeting, etc. etc.

So who’s fighting? Well, my employer (Right Media) for one. Doubleclick is said to be launching a marketplace, AdECN is another. I’d expect others to start soon — as long as someone hasn’t won, there’s still a chance.

Well, as we all know, Right Media has been bought by Yahoo (if you hadn’t heard yet, the deal closed today), Google is buying DoubleClick, etc. etc. etc. So how are these developments changing the battle over the cookie?

There won’t be a single cookie

That’s right. It ain’t happening. At the minimum there are going to be three different marketplaces, three different adservers and hence three different cookie domains. Think about it — Google/Yahoo/Microsoft are arch-rivals and even though some may build more open solutions than others they are most definitely not going to be fully integrated, and they most definitely won’t be sharing a single cookie space. Add on to that the remaining independent adservers (e.g. AdECN, Zedo, OpenAds) and I don’t see any way in which there will be one unified marketplace.

To be honest, this saddens me quite a bit. One single marketplace would have been extremely beneficial to both publishers and advertisers, but of course there are simply too many people fighting to control the means by which ads are transacted. Ok, so now what?

What’s next?

To be honest — it’s too soon to really tell how this new battle is going to unfold. I don’t think it’s very clear what Microsoft, Yahoo or Google (how about we call them MYG) are going to be doing with their new acquisitions. One thing is clear, it’s going to be difficult to get access to inventory without working with MYG. Advertisers should benefit from consolidated buying. I imagine that networks not working with MYG will find it difficult to survive without a really compelling story and publishers should benefit from increases in both innovation and competition.

In the next couple posts I will be digging into how companies should prepare for this new online advertising landscape — How will ad-networks continue to grow over the next couple years? How can large publishers increase rates by leveraging the new marketplaces? How will behavior work without a single cookie? CAN behavior work cross-platform?